The cryptocurrency market faced a severe correction in the past week. It underperformed traditional assets such as gold and equities, but the main cause cannot be fully attributed to macroeconomic instability alone, but also the trembling trust in DeFi as the SushiSwap incident shook the DeFi community’s faith in projects.

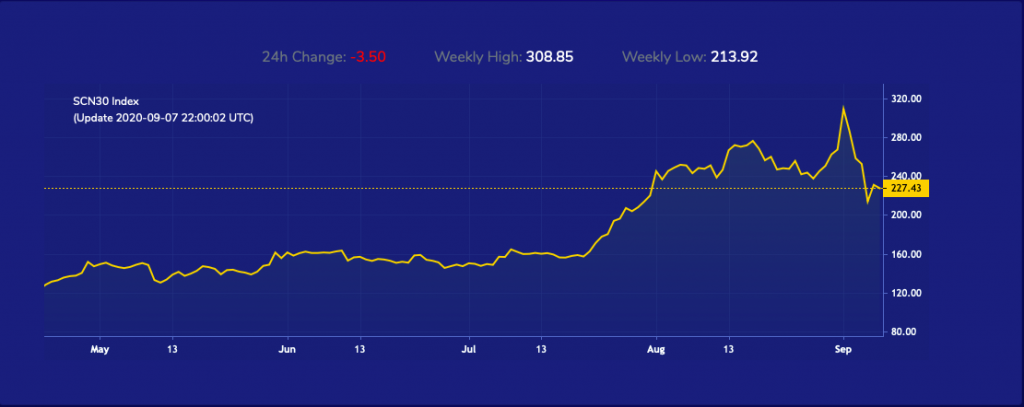

The SCN30 Index is still free-falling from its peak at 308.85 to 227.43 points, reflecting more than a 35% drop in a week. The index suffers from the plunge in prices of top constituents such as Ethereum (ETH), Ripple (XRP), and ChainLink (LINK) as they are weighted the most on the index.

Other assets like Bitcoin (BTC) is down -12.14%, gold dropped slightly at -2.15%, WTI crude oil fell another -8% while stock indices Nasdaq (NDX) corrected down -4.03% and the S&P 500 (SPX) down -2.1% during the past seven days.

YFI and LEND Technical Analysis

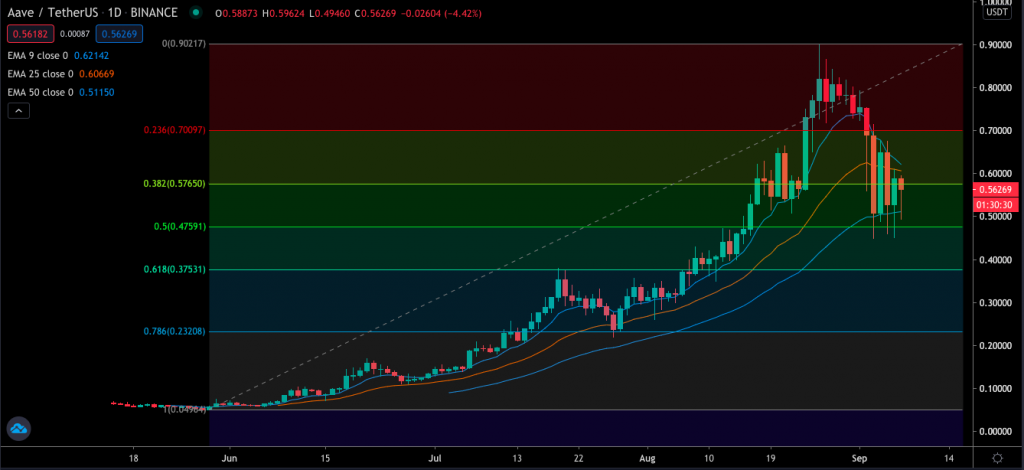

Yearn.finance (YFI) and Aave (LEND) are the two hottest DeFi tokens recently listed on the SCN30 Index. LEND is Aave’s native token which secured more than $1.37 billion worth of total value locked (TVL) in its protocol and ranked second on DeFi analytics platform DeFi Pulse. Holders of LEND will have the rights to vote on the directions and changes of the protocol.

Recently, Aave just received the license from the United Kingdom’s monetary watchdog, the Electronic Money Institution (EMI), which allows them to conduct business involving the transaction of electronic money.

Since its listing on Binance back in May, LEND surged over 1,350% to an all-time-high (ATH) at 90 cents. Despite the recent correction, the token is still offering 850% returns since being listed.

The daily EMA50 is providing formidable support for LEND as it bounced multiple times off the line. Currently, the price is standing above both EMA50 at $0.511 and Fibonacci’s level at $0.475, preventing the trend from flipping bearish. However, it would be optimal to wait for the price to stand back above all EMA9, 25, and 50 lines for a bullish confirmation before a buy-in.

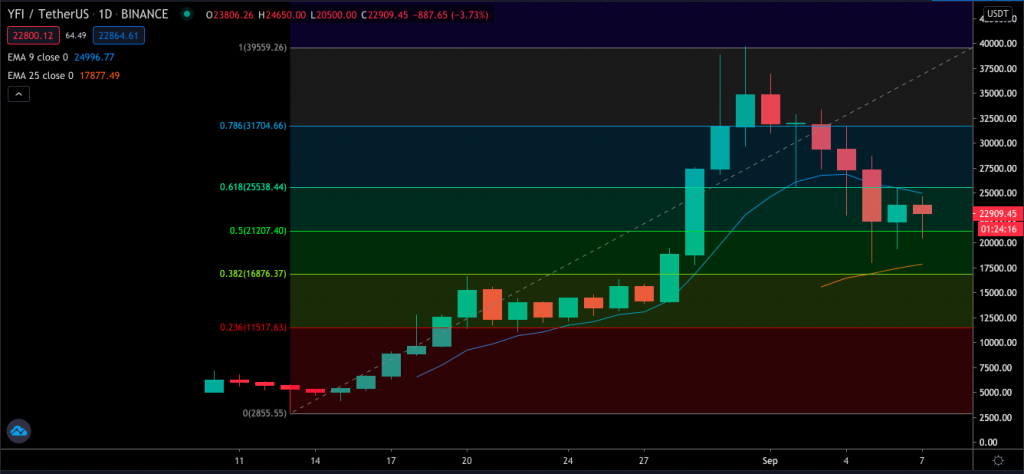

Year.finance is the DeFi lending aggregator comprising Compound, Aave, Fulcrum, dydx, ddex, and dForce. YFI currently has the TLV of $763 million, ranked in fifth place.

YFI stands out immediately due to its very limited token supply of 30,000. Users can obtain YFI via providing liquidity in the pool using yTokens. YFI also functions as a governance token as it allows its holder to vote on the direction of the protocol.

From the technical analysis perspective, the price corrected heavily from the ATH at $40,000 and now bounced back slightly above the daily EMA25 at $18,782. Looking for buy-in opportunities when YFI is able to reclaim the EMA9 above $25,000 or when the price faces another pull-back to retest EMA25 and bounce.

Disclaimer: This analysis is the view of the author’s alone, and does not in any way represent trading advice. all traders should trade at their own risk.

You may also want to read: Chef Nomi Hands Over Sushiswap to FTX CEO After Controversial Weekend Cashout