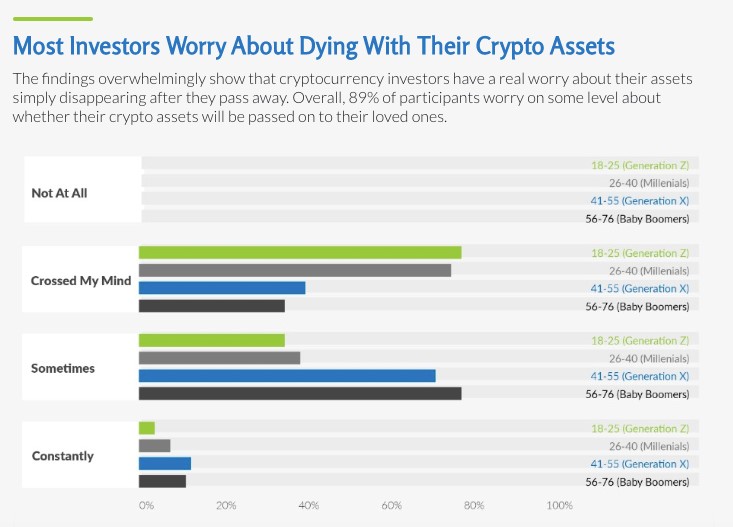

Financial advisory The Cremation Institute published a study on July 7 regarding what crypto traders think about digital asset ownership after death and found that 89% of these traders are concerned about the permanent loss of their funds in this case.

Unsurprisingly, a majority of traders do not have a plan for the transfer of their digital assets to their families and loved ones in the event of their sudden passing. Only 23% of traders were found to have proper plans, which includes either leaving instructions to their families directly for the access to their assets, or drawing up wills to ensure timely asset transfers to the necessary individuals involved.

What is the best method to store the instructions that will give access to your digital assets? 65% of traders surveyed said that they store them somewhere in the house, 17% on computers, 15% on a USB drive and 2% in safety deposits. Only 7% of traders have included digital asset ownership transfers in wills.

“According to Coinmetrics.io, there are currently 12,000 Bitcoin millionaires in the world. But with those 12,000 millionaires, there are also a tragic number of crypto investors who pass away each year, with their family unable to access their funds. According to Coincover, it is estimated that around 4 million Bitcoin (Approx 40 billion USD) has been forever lost due to death,” the study states.

Across different generations, the study finds that millennials are five times more likely to neglect future planning as compared to Baby Boomers. However, as death is a concept that grows imminently closer to individuals with the passing of time and age, it is perhaps a given that older traders will have more considerations on the matter than millennial or Gen-Z traders.

You may also want to read: Bad at Trading? Try Dollar Cost Averaging for Long-term Investment