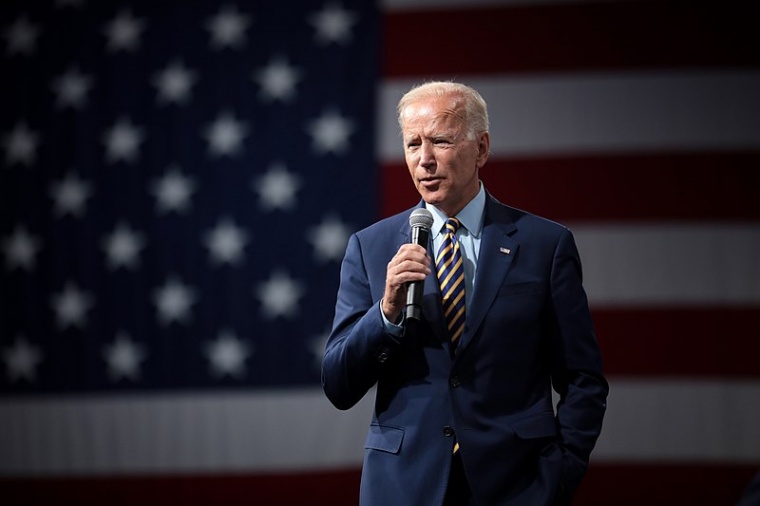

According to a March 8 Wall Street Journal article, US President Joe Biden will suggest alterations to crypto taxes in a forthcoming budget plan on March 9, 2023.

It is reported that the proposed law change would mainly target wash trading — which is an illegal practise where investors may sell a losing investment asset to claim a tax deduction and then repurchase it. While wash trading is already prohibited in the trading of stocks and bonds, it has yet to be applied for cryptocurrency trading.

The new crypto tax law is expected to generate $24 billion in revenue. It will be a component of Biden’s larger 2024 budget proposal, which seeks to lower yearly federal budget deficits by $3 trillion. The Republican party, which presently holds a majority in the House despite Biden’s Democratic leadership and a Democratic Senate, may oppose the measure, making its adoption less likely.

While Biden’s changes may or may not be implemented, other recent tax policy changes will have an impact on U.S. crypto investors during the next tax season.

In February, the U.S. Internal Revenue Service (IRS) broadened the scope of the crypto tax laws to require anybody dealing with digital assets to declare their activity.

Last year, the IRS’ updated draft instructions for the 2022 tax year suggested that non-fungible tokens (NFTs) may be subject to taxation. In that same year, the Infrastructure Investment and Jobs Act was updated to require crypto exchanges and wallets to generate and issue 1099-B forms to their customers.