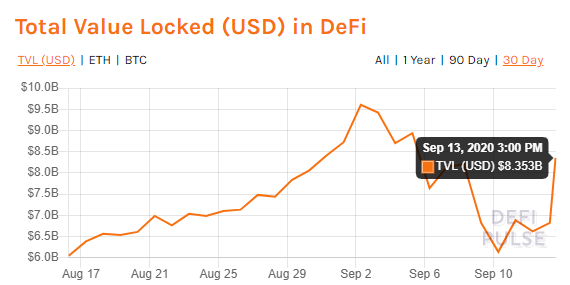

Last week, the SushiSwap incident caused the market to panic sell, decentralized finance (DeFi) market capitalization plunged by almost 50% as the majority of traders got burnt in the SushiSwap sell-off.

Over the weekend, however, the total value locked (TVL) in DeFi protocols has seen a significant recovery. The TVL increased more than $1.4 billion in less than 24 hours, with the locked assets on Balancer jumping up almost 25%.

According to the data on DeFi Pulse, Aave, the decentralized lending platform is still in the lead in terms of TVL at $1.56 billion. Followed closely by another lending protocol, Maker, and Curve Finance, a decentralized exchange (DEX), at $1.26 billion and $1.02 billion respectively.

The yearn.finance (YFI) also created a new all-time high (ATH) when price broke above $40K level and rallied to a new peak at $43,966 on Binance. Following suit, the YFI’s fork DFI.money (YFII) and YF Link (YFL) also witnessed double-digit gains.

SushiSwap, however, remains stagnant after a short recovery from the swing-low at $1.13. Now SUSHI is being traded at $2.54, down 84% from its peak created on September 1st at $15.97 on Binance.

You may also want to read: Yearn.Finance Unveils New Protocol StableCredit