Shortly right after the peak of DeFi hype in September, the DeFi sector faced severe sell-offs throughout the following month causing most of the projects to take nosedives and created new lows. Come November, as Bitcoin rallies vigorously, DeFi projects also begin to recover as multiple tokens signaling signs of reversal.

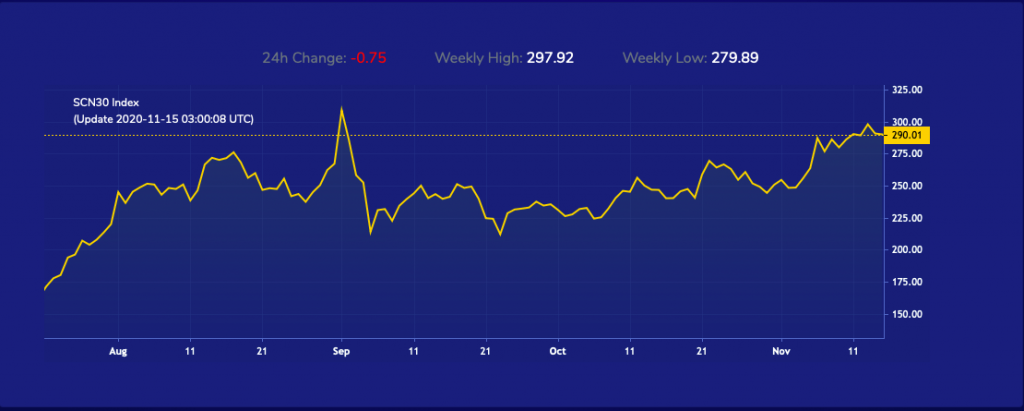

The rebound of many top DeFi projects indicates that the sector is still very much alive. The SCN30 Index comprising top Altcoins along with DeFi tokens is seeing steady recovery to 290 points this month, a few percentages away from the Index’s all-time high (ATH) at 310.

Moreover, according to the DeFi data aggregator, DeFi Pulse, the total value locked (TVL) on DeFi protocols has been increasing to the new ATH of over $13 billion worth of digital assets. This proves that the fundamental strength of DeFi is still intact as investors have not lost faith in the decentralization of the financial system despite most tokens are still more than 50% down from their ATHs.

Today, we will explore the charts of the top three DeFi projects including Yearn Finance (YFI), Aave (AAVE), and Synthetix (SNX) which are all flashing signs of reversal.

YFI Technical Analysis

Yearn Finance (YFI) previously made a swing-low at $7,424 marking the local bottom since the bullish breakout in August. It only took less than a week for the price to recover more than 100% and now is trending at $17,700. Now, YFI needs to surpass $19,550 to create a first major higher-high which should send it to test the next overhead resistance at $21,400. The mid-term target lies at $30K which served the last local top before the breakdown. The potential upside for this is more than 70% which can be considered a lucrative trading opportunity.

AAVE Technical Analysis

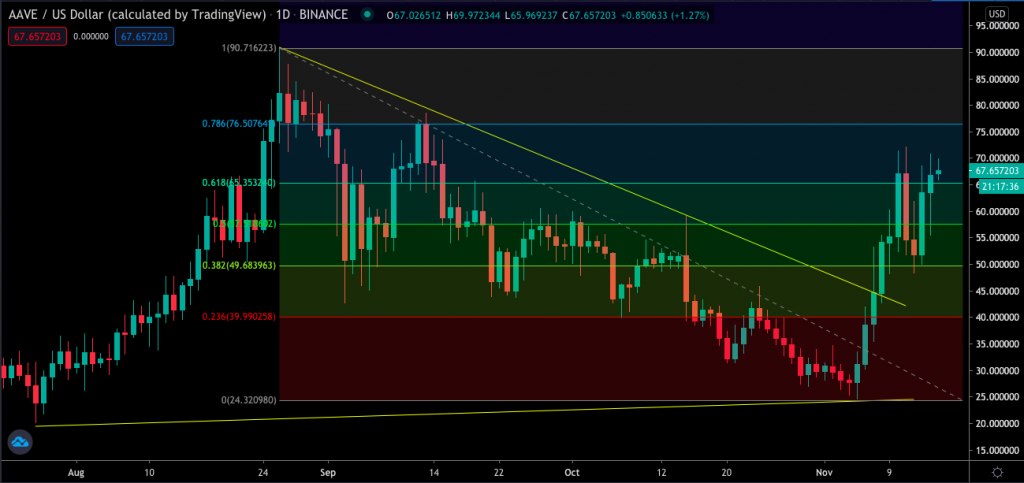

Aave (AAVE) or known as LEND before the migration, has successfully broken above the suppressing trend line in yellow. From the swing-low at $25, AAVE has experienced massive buying pressure which pushed the price through multiple resistances and created a prominent higher high. Since then, the price has been cooling off for a brief moment before surging back up again indicating high interest in the project’s token.

Short-term resistance for AAVE is located at $76 dollars which was a previous local top as well as Fibonacci’s retracement level. Surging past that will send AAVE to retest the ATH at $90 made during August DeFi’s bull run.

SNX Technical Analysis

Synthetix (SNX) displayed a similar breakout to that of AAVE. The token rebounded from a swing-low at $2.5 and now created its first higher high at $4.8 without retracing down and creating a lower-low.

In the short-term, the next target for SNX will be to create consecutive higher highs at $5.14 and $6.5 respectively. The final destination before entering a new price discovery phase is at $7.87 which is the current ATH.

Disclaimer: This analysis is the view of the author’s alone, and does not in any way represent trading advice. all traders should trade at their own risk.

You may also want to read: Leading DeFi Protocol Synthetix Delves into Oil Market, Offers Brent Crude Oil Futures