According to the CEO of Tokyo-based financial services firm Monex Group, Oki Matsumoto, the company has expressed interest in acquiring the Japanese division of Sam Bankman-Fried’s now-shuttered FTX cryptocurrency platform.

In response to a query on the imminent sale of the Japan FTX unit, Matsumoto said to Bloomberg, “Generally speaking, we naturally are interested.”

The sale of FTX’s Japanese division is taking place as part of the insolvency proceeding that is currently underway in the US. As per court documents, 25 of the 41 parties who have expressed interest in acquiring a piece of the bankrupt group have already made private agreements with the debtors.

Matsumoto is expecting that Japanese businesses will soon look to invest in digital coins and use NFTs for marketing, and he wants to make sure that his organisation is one of the few able to provide the essential services when needed.

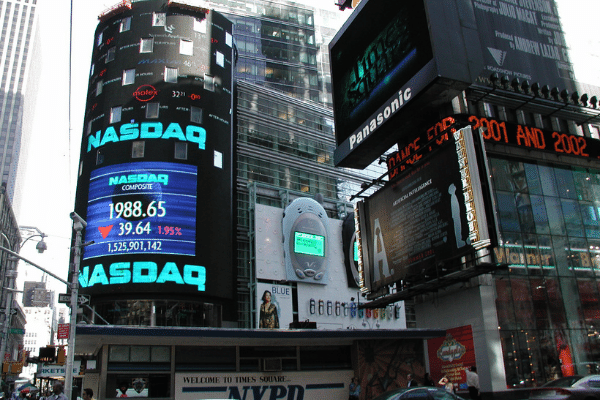

The troubled cryptocurrency exchange Coincheck, which had been wrecked by hackers, was acquired by Monex in 2018. The decision was made as an addition its current stock and Forex service offerings. Matsumoto stated at the time that the efforts to list Coincheck on the Nasdaq stock exchange were moving along as planned.

Prior to the company’s closure at the end of November, FTX Japan reported having about $139 million in cash and deposits on hand, as well as about $77 million in net assets at the end of September. Beginning the following month, the business intends to permit consumers to withdraw their money.