- US$550 billion infrastructure bill may be delayed because of language of cryptocurrency taxation provisions

- Current language would leave out certain interest groups from having to make declarations for cryptocurrency taxes over US$10,000, but Democrats backed by the Biden administration want the bill to cover more stakeholders with fewer exceptions

It was meant to be a moment for celebration. After over a decade of lobbying, the moneyed crypto class were about to have their cake and eat it – a US$550 billion infrastructure bill that recognized the nascent asset class but confined its taxable exposure.

Slipped in at the last minute, a cryptocurrency tax that was supposed to add an estimated US$28 billion to Washington’s coffers, hitched a ride on a bipartisan US$550 billion infrastructure bill by requiring cryptocurrency transactions over US$10,000 to be declared.

But the addition was considered too wide and was to be curtailed somewhat thanks to an increasingly vocal and deep-pocketed crypto lobby that had garnered bipartisan support to amend the width of those declarations, until a competing version proposed by Democrats and backed by the Biden administration, look set to delay the entire infrastructure bill.

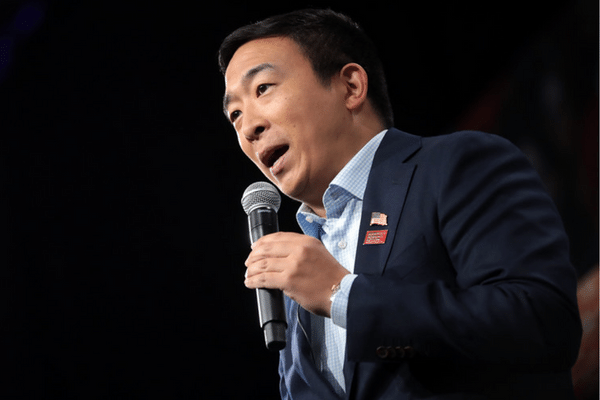

The Blockchain Association, an increasingly powerful trade group for the cryptocurrency industry, has been mounting an eleventh-hour pressure campaign, to pass the infrastructure bill as is, which would exclude miners, software designers, protocol developers and other select parties from having to make those cryptocurrency transaction declarations to the IRS.

The competing version doesn’t make quite as many exceptions and would require a far broader number of stakeholders to declare their cryptocurrency transactions.

Both versions of the cryptocurrency portions of the infrastructure bill are mutually exclusive and it’s not entirely clear what happens next, but failure to come to a decision on the wording of the cryptocurrency provisions could delay the infrastructure bill even further.

Either way, the move to tax cryptocurrency transactions should be welcome because it’s a precursor to formalizing recognition of the asset class and providing the regulatory framework for broader institutional adoption and mainstream acceptance.