- The U.S. Securities and Exchange Commission has warned Coinbase that it will sue the cryptocurrency exchange if it launches a new digital asset lending product.

- But the SEC moves could have the deleterious effect of pushing cryptocurrency exchanges offshore and it’s unclear what the ultimate goal of the regulator is.

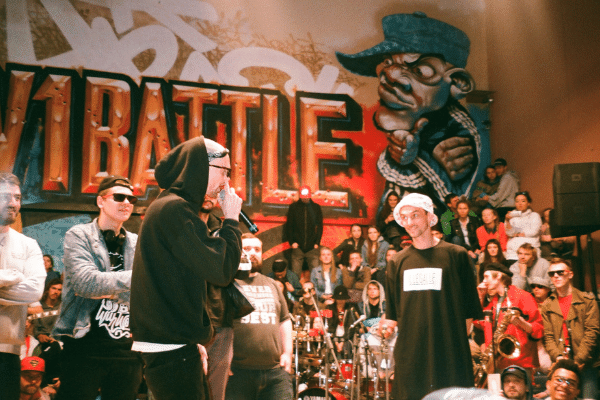

“So the SEC won’t let me be, or let me be me, so let me see.

They try to shut me down technically, but it feels so empty without me.”

– adapted from the lyrics of “Without Me” by Eminem off the album The Eminem Show © 2002

With the first round going to cryptocurrency exchanges like Binance, which regulators like the U.K.’s Financial Conduct Authority have conceded that they are struggling to oversee let alone sanction, U.S. regulators are taking a different tact, sue what you can see.

The hitherto unregulated and unregulatable cryptocurrency industry is entering a new phase with early efforts to reign in the relentless march of gray-zone exchanges like Binance failing to yield fruit and regulators now gunning for the targets that they can reach with the latest being U.S.-listed Coinbase Global (-3.23%).

The U.S. Securities and Exchange Commission has warned Coinbase that it will sue the cryptocurrency exchange if it launches a new digital asset lending product.

Designed to allow users to earn interest on certain cryptocurrencies deposited with the exchange, Coinbase’s product called “Lend” (no prizes here for creativity in naming) is not new in the digital asset sphere.

Exchanges have long been offering attractive yields to depositors who lend cryptocurrencies on their platforms and Coinbase would hardly be the first, but the SEC’s contention is that such a product would be considered an “investment contract” thus making it a security under federal law and needing to be registered.

Using what the “Howey test,” a seminal case for determining whether an investment contract creates a security, the SEC argues that Coinbase’s Lend product creates such a circumstance and therefore could become an unregistered security if launched

Brian Armstrong, Coinbase Global’s CEO took to Twitter to express his frustrations at the SEC action,

“They are refusing to offer any opinion in writing to the industry on what should be allowed and why, and instead are engaging in intimidation tactics behind closed doors.”

“Whatever their theory is here, it feels like a reach/land grab vs other regulators.”

And Armstrong may have hit the nail on the head, because SEC Chairman Gary Gensler has gone hat in hand to Congress before, asking for more sweeping powers to regulate the nascent cryptocurrency space, while maintaining in the same breath that the SEC already has all the powers it needs to police the vibrant industry.

But the SEC moves could have the deleterious effect of pushing cryptocurrency exchanges offshore and it’s unclear what the ultimate goal of the regulator is.

Coinbase’s Lend product could just as easily be said to resemble a savings deposit, paying out a fixed interest on deposited digital assets and therefore within the purview of the Office of the Comptroller of the Currency.

Under the Trump administration, the OCC had clarified that national banks could accept dollar deposits to back up stablecoin issuances, albeit with far more stringent and conservative control measures in place.

Nonetheless, the inter-agency land grab as alluded to by Armstrong may be precisely what the cryptocurrency space doesn’t need at the moment.

Given the decentralized nature of the industry and as demonstrated by cryptocurrency exchanges like Binance, regulators and national governments are better served by putting out clear guidelines or risk alienating those digital asset innovators to base themselves offshore.

Take FTX for instance, one of a clutch of rising cryptocurrency exchanges with an American founder and CEO but headquartered in Hong Kong.

If the U.S. is to genuinely become a leader in the cryptocurrency space and not lose the race for digital asset dominance to other countries, piecemeal enforcement actions such as the one contemplated against Coinbase will be counterproductive and counterintuitive.