According to the Independent Reserve Cryptocurrency Index Singapore 2023 report, women in Singapore are slightly more likely than men to profit from their cryptocurrency investments or at the very least break even.

In February, 1,500 average Singaporeans participated in the Independent Reserve Cryptocurrency Index (IRCI) survey, which asks participants about their sentiments on cryptocurrencies.

The survey results stated 76% of women said they had either made money or broken even on their cryptocurrency investments — as opposed to only 72% of men. It stated that this is the first time that female traders are “reported to be outperforming their male counterparts” since the launch of IRCI Singapore 2021.

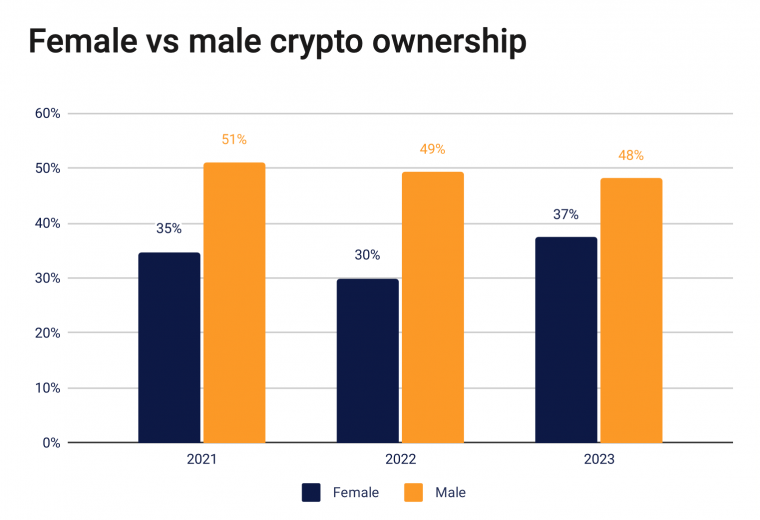

The increase of female investors is exceeding that of male users from 2021 to 2023. 37% of women, which increased by 7% since 2022, invested in cryptocurrencies. Compared to 48% of men who invested in crypto, which has decreased by 1%.

There has been a significant change in how women all around the world are making investments. By adopting financial investments, women are taking proactive measures to increase their wealth. Compared to 53% of males, 56% of women said they bought cryptocurrency to diversify their investment portfolio. Furthermore, 37% of the women investors said that part of their reason to invest was to become wealthy.

24% of female traders reported that over 20% of their investment portfolio consists of crypto. In addition, 48% of respondents indicated they planned to increase their existing cryptocurrency investments over the next 12 months, while 43% said they wanted to diversify into other tokens, DeFi initiatives, or NFT projects.

Besides the fact that female crypto traders are thriving, the survey results also reported that higher-income Singaporeans are more inclined to invest in cryptocurrencies and prefer to devote a larger portion of their portfolio to it. The majority claimed that their investments either generated profits or a profit-neutral return.

Many cryptocurrency investors remain optimistic despite the general public losing both short- and long-term faith. In actuality, individuals who hold their cryptocurrency investments for extended periods of time have reported generating profit.

Singapore’s Gen Z population, comprised of those aged 18 to 25, is cautiously optimistic about cryptocurrencies and has a wait-and-see mentality. They desire additional education and keep a watchful eye on the media. Whilst many would like to, they are not in a position financially to make significant investments in cryptocurrencies. Although Gen Z is the most indifferent to cryptocurrency preferences, they are also the least likely to believe that Bitcoin is a ponzi scheme.