A federal district judge has rejected the summary judgment requested by both the Securities and Exchange Commission (SEC) and Ripple in the ongoing enforcement case regarding whether XRP is an unregistered security. The decision by Judge Analisa Torres of the Southern District Court of New York means that the dispute between Ripple and the SEC will proceed to trial, extending the years-long legal battle, media reports said.

The core issue at hand is whether Ripple’s native cryptocurrency, XRP, should be classified as an unregistered security, and if the substantial funds raised through its sale were obtained unlawfully.

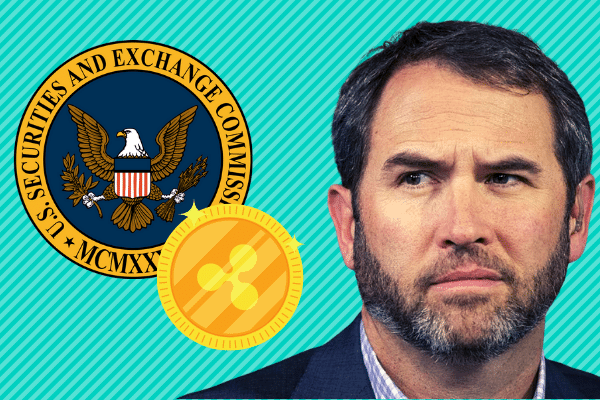

In 2020, the SEC accused Ripple of generating $1.3 billion through the sale of XRP and filed a lawsuit against Ripple’s CEO Brad Garlinghouse and co-founder Christian Larsen. With a market capitalization placing it as the sixth-largest cryptocurrency, XRP’s total market value exceeds $27 billion.

Judge Torres granted partial summary judgment motions from both parties, leaving the case open until a jury can provide their verdict at trial or if a settlement is reached.

In her ruling, the judge stated, “The SEC’s motion for summary judgment is GRANTED as to the Institutional Sales, and otherwise DENIED. Defendants’ motion for summary judgment is GRANTED as to the Programmatic Sales, the Other Distributions, and Larsen’s and Garlinghouse’s sales, and DENIED as to the Institutional Sales.”

The judge will announce the trial date in a separate order. Brad Garlinghouse expressed his optimism in a tweet, saying, “We said in Dec 2020 that we were on the right side of the law, and will be on the right side of history. Thankful to everyone who helped us get to today’s decision—one that is for all crypto innovation in the US. More to come.”