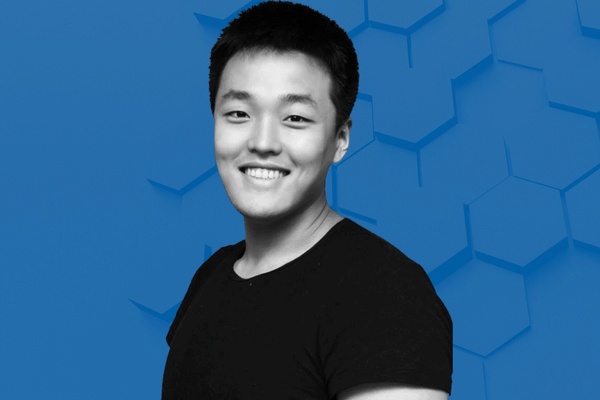

The United States Securities and Exchange Commission (SEC) has charged fugitive Terraform founder Do Kwon with multibillion-dollar fraud. It also alleged that Kwon cashed out nearly 10,000 BTC amid through a Swiss bank while his company and its coins were crashing.

The SEC lawsuit claimed that Do Kwon and his company Terraform Labs is responsible for the historic collapse of stablecoin Terra USD which caused a giant $40 billion wipeout last year, a Bloomberg report said.

Terraform Lab was a Singapore-based tech organization that created Terra USD and Terra Luna tokens. According to the SEC chairman, Garry Gensler, Do Kwon and his organization intentionally misled investors and didn’t provide users with complete, truthful, and genuine disclosure, which is crucial for a crypto asset security host.

Gensler also claimed that Kwon and his organization have given multiple vague and misleading statements to the investigating agencies to develop trust. SEC revealed that Kwon and his company raised billion-dollar investments, and in return, they sold them “an interconnected suite of crypto asset securities.” What’s more, the majority of those transactions were unregistered.

Terraform continued to claim that the tokens would create value in the long run. However, in actuality, they plunged to almost zero in May 2022. The complaint, however, did not reveal Kwon’s location. South Korean authorities claimed that he could be in Serbia. An arrest warrant has already been issued by a South Korean court for Kwon.

Kwon has denied the alleged claim of hiding, but he never came forward to disclose his whereabouts. He challenged SEC through tweets, declaring that he and his organization are ready to cooperate with government agencies and have hardly anything to hide.