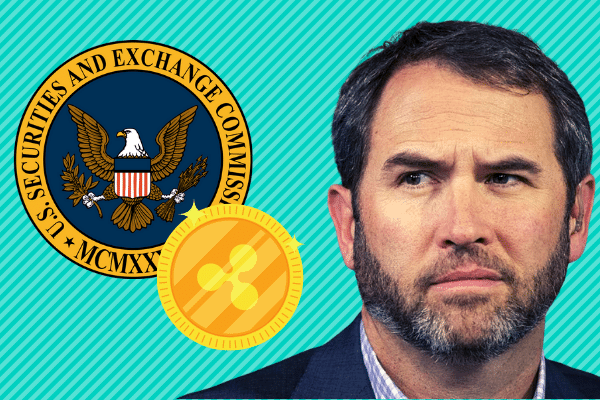

As the cryptocurrency industry continues to evolve, voices demanding accountability within the United States Securities and Exchange Commission (SEC) are growing louder. Industry think tanks and prominent figures, including Stuart Alderoty, Chief Legal Counsel at Ripple Labs Inc, are raising concerns about a perceived conflict of interest among the SEC’s leadership.

The recent controversy stems from a Twitter thread by Jake Chervinsky, Blockchain Association Policy Lead, in which he accused SEC Chairman Gary Gensler of prejudging all digital assets as securities. Chervinsky argued that Gensler’s preconceived notion compromises his ability to impartially handle enforcement actions related to the nascent asset class and called for his recusal from such matters.

Chervinsky highlighted the importance of the Wells Process, which mandates that SEC enforcement cases be impartially assessed by neutral commissioners. However, he argued that Gensler’s consistent classification of cryptocurrencies, other than Bitcoin, as securities demonstrates his lack of neutrality. Industry insiders, including Chervinsky, believe that the SEC chair’s stance fails to engage in the thorough analysis necessary to determine whether each crypto asset should be considered a security.

The SEC has been particularly active in enforcing regulations within the cryptocurrency space this year, initiating actions against major exchanges such as Kraken, Bittrex, Coinbase, and Binance. While the focus on crypto firms is raising eyebrows, industry leaders have also accused the commission of showing favoritism, particularly in its treatment of the now-bankrupt FTX derivatives exchange.

Stuart Alderoty, among those calling for accountability at the SEC, recently emphasized the legal consequences of Chairman Gensler’s statements. He echoed concerns that the SEC’s leadership may have a conflict of interest, which could impact their ability to impartially regulate the industry.

The growing discontent within the industry reflects the need for clear and unbiased regulation that considers the unique characteristics of cryptocurrencies. Critics argue that a one-size-fits-all approach, categorizing all digital assets as securities, hinders innovation and fails to recognize the distinct nature of different cryptocurrencies.

As calls for accountability at the SEC intensify, it remains to be seen how the regulator will address these concerns and whether Chairman Gensler will respond to the allegations of prejudgment and conflict of interest. The evolving crypto landscape calls for a balanced and thoughtful approach that strikes the right balance between investor protection and fostering innovation in this nascent industry.