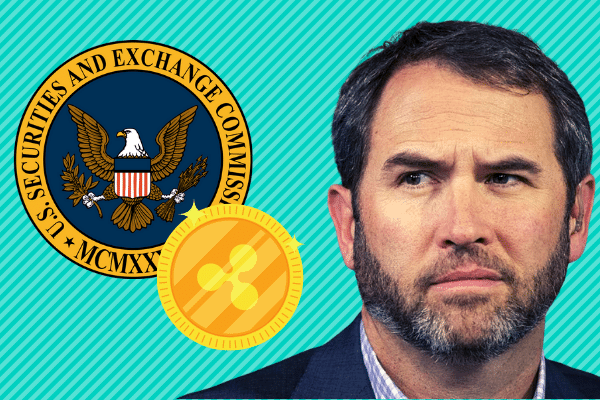

Ripple Labs CEO Brad Garlinghouse recently criticised the regulations on local crypto firms imposed by the US Securities and Exchange Commission (SEC) for the lack of consistency.

During the Collision conference in Toronto, Garlinghouse referenced the current legal war between Ripple and the SEC as the former is being sued for the sale of XRP tokens. According to the SEC, the XRP is considered an “unregistered digital asset security.”

However, it would seem that the SEC is making some kind of exception for Coinbase as the Commissioner approved Coinbase’s public offering in April 2021 in spite of the crypto exchange’s listing of XRP at the time.

“The SEC now seems to take the position when they sued us that ‘XRP is a security and always has been’, but they approved Coinbase going public even though Coinbase is not a registered broker-dealer.

There’s some contradictions here of the SEC almost not, within its organization, knowing left hand, right hand.”

Brad Garlinghouse, CEO of Ripple Labs

Garlinghouse added that SEC decided to carry out their regulations via enforcement instead of going the extra mile to define a new set of clear rules, which he derided it to be inefficient and innovation stifling.

The Ripple CEO is not the only one who have raised complaints about the US regulators. Ripple’s co-founder Chris Larsen and CTO David Schwartz have also done so before and after the SEC filed its lawsuit against the firm. Larsen stated in October 2020 that their company is pondering over leaving the US soil, considering the authorities’ tendency to carry out enforcement as regulation.

Ripple’s headquarter currently resides in San Francisco, and has offices in Wyoming and Dubai.

Garlinghouse remarked that crypto is not the “Wild West” at all. While there’s no doubt that crypto is indeed a volatile asset class, all asset classes come with a varying degree of volatility. He believes that it’s not a regulator’s duty to determine how that volatility should be accessed by consumers and businesses.