As the legal battle between U.S. blockchain company Ripple and the US Securities and Exchange Commission (SEC) wages on, Ripple plans to base its legal argument that its token, Ripple (XRP), cannot be regarded as a security in the absence of contracts because there is no “investment contract” that would grant rights to investors.

As the legal battle between U.S. blockchain company Ripple and the US Securities and Exchange Commission (SEC) wages on, Ripple plans to base its legal argument that its token, Ripple (XRP), cannot be regarded as a security in the absence of contracts because there is no “investment contract” that would grant rights to investors.

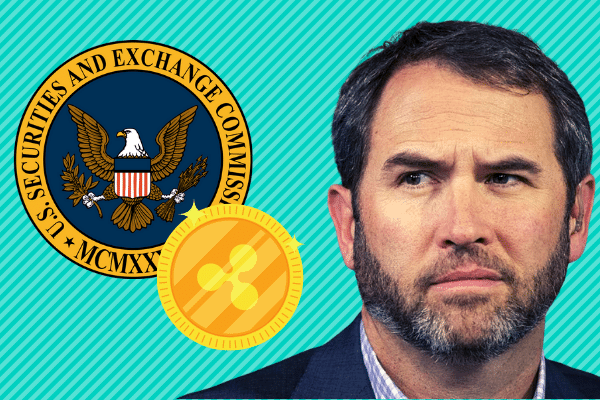

The case brought by the American regulator against the company is that XRP is an unregistered security, which Ripple denies. In another chapter of the courtroom saga, the blockchain firm filed a motion to have the case dismissed prior to trial in a federal court in Manhattan, according to Bloomberg.

Both parties called for a prompt ruling in the agency’s case against the business earlier this month, giving XRP investors hope that Ripple’s legal issues would be resolved very soon, potentially driving up the price of its native coin.

On the day when the documents were filed, Ripple CEO Brad Garlinghouse tweeted that “today’s filings” confirmed that the SEC is more interested in changing the law to expand their jurisdiction than actually applying them.

Today’s filings make it clear the SEC isn’t interested in applying the law. They want to remake it all in an impermissible effort to expand their jurisdiction far beyond the authority granted to them by Congress. https://t.co/ooPPle3QjI

— Brad Garlinghouse (@bgarlinghouse) September 17, 2022

The two entities are requesting a “summary judgement,” which indicates that neither the plaintiff nor the defendant wants the legal action to proceed to a full trial, according to court documents submitted on September 18.

In July, the SEC attempted to prevent holders of Ripple (XRP) and lawyer John E. Deaton from supporting Ripple in its legal struggle and has since barred them from taking part in the proceedings. Deaton had 3,252 affidavits from token owners stating that they have lost money as a result of the SEC’s case against Ripple.