Ripple Labs and the U.S. Securities and Exchange Commission (SEC) have jointly requested a 60-day suspension of their ongoing appeals, signaling a significant step towards a potential resolution in their long-standing legal battle over XRP sales.

In a filing on Thursday, the two parties stated that an “abeyance would conserve judicial and party resources while the parties continue to pursue a negotiated resolution of this matter.” The document further revealed that Ripple and the SEC have reached an “agreement-in-principle” to settle the dispute, which includes both the SEC’s appeal and Ripple’s cross-appeal, contingent upon approval from the Commission.

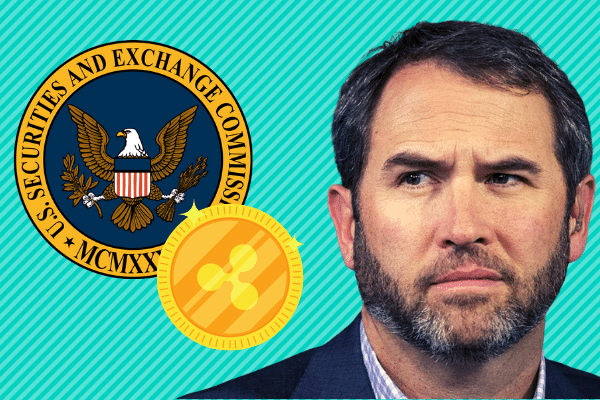

The high-profile lawsuit, initiated by the SEC in late 2020, accused Ripple of violating federal securities laws through its sale of XRP tokens. The central point of contention was whether XRP should be classified as a security.

The case has witnessed notable developments, particularly following the election of U.S. President Trump, which has been associated with a perceived shift towards a more accommodating stance on cryptocurrencies by the SEC. In recent times, the regulatory body has withdrawn lawsuits against several other crypto firms, including Coinbase and Kraken.

Earlier, Ripple CEO Brad Garlinghouse indicated that the SEC had withdrawn its appeal regarding a previous court ruling that determined Ripple’s programmatic sales of XRP did not constitute securities violations. Ripple’s Chief Legal Officer, Stuart Alderoty, later confirmed the company’s decision not to proceed with its cross-appeal.

The joint filing emphasized that “the parties require additional time to obtain Commission approval for this agreement-in-principle, and if approved by the Commission, to seek an indicative ruling from the district court.”

While the SEC lawsuit heavily focused on the security status of cryptocurrencies, the agency’s current leadership is reportedly focusing on identifying cryptocurrencies that do not meet the definition of a security. Last month, the SEC publicly stated that memecoins are generally not considered securities, although it cautioned that some could be subject to enforcement actions in cases of fraud.