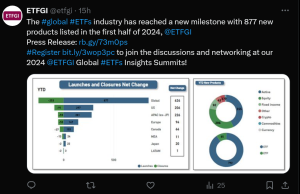

In the first half of 2024, a remarkable 37 new crypto exchange-traded funds (ETFs) and exchange-traded products (ETPs) were introduced worldwide. This surge is part of a broader trend, with a total of 877 new ETFs and ETPs launched globally, as reported by the research firm ETFGI.

What does this influx mean for the crypto market? The addition of these 37 new crypto ETFs and ETPs signifies a growing interest and investment in digital assets, marking a new record that surpasses the previous high of 808 new ETFs launched in the first half of 2021.

While there were also closures, with 253 ETFs shutting down, the net increase still stood strong at 624 new products. This reflects a dynamic and evolving market where new opportunities continually emerge.

U.S. Market Leads with New Launches and Closures:

In January, the Securities and Exchange Commission (SEC) approved a range of spot Bitcoin ETF applications. By July, a series of spot Ethereum ETFs also received approval.

BlackRock continues to dominate the market in terms of new listings. The firm listed 44 new products and remains the world’s largest ETF manager by assets under management (AUM). As of December 31, 2023, BlackRock manages $3.5 trillion in global ETF investment vehicles.

What drives the U.S. market’s leading position? The U.S. spearheaded the charge with 297 new products, followed closely by the Asia Pacific region (excluding Japan) with 281, and Europe with 147. The U.S. also experienced the highest number of closures, with 91 ETFs shutting down, compared to 55 in the Asia Pacific region and 53 in Europe.

The distribution of new launches varies across regions, reflecting the global reach and diverse market interests in ETFs and ETPs. A total of 219 providers contributed to the new listings, indicating increasing competition in the ETF market.

Why is there such a dynamic fluctuation in the ETF market? ETFs and ETPs are available across 35 exchanges globally, offering investors a variety of strategies and asset classes. The 182 closures were linked to 73 providers across 29 exchanges, highlighting the continuous evaluation of products.

Diverse Investment Strategies and Growing Popularity

Data reveals that the new ETFs and ETPs encompass a diverse range of investment strategies. Of the new products, 355 are active funds, 296 track equity indexes, and 92 follow fixed-income indexes.

Why are active funds gaining traction? According to ETFGI, active funds are particularly popular as investors seek to outperform market benchmarks through skilled management and strategic asset allocation.

The launch of 37 new crypto ETFs and ETPs in the first half of 2024 underscores the growing acceptance of crypto as part of diversified investment portfolios. These products have attracted significant interest from both institutional and retail investors.

What does this trend mean for the future of crypto investments? The increasing number of crypto ETFs and ETPs indicates a broader acceptance and integration of digital assets into mainstream financial markets, potentially paving the way for more innovation and growth in the sector.