The lawmakers of the Kentucky state have approved a bill that offers tax incentives to bitcoin miners on Kentucky grounds, making the state more alluring to bitcoin miners.

The bill in question, House Bill 230, states that bitcoin miners are exempted from some tax obligations. The bill is also looking to increase more job opportunities and encourage the growth of the industry.

House Bill 230 was passed with 19:2 votes by the Kentucky legislators. News media Lexington Herald-Leader reported that:

“The bill’s fiscal note estimated its cost to the General Fund to start at $1 million a year. But the full cost after that cannot be determined, legislative staff wrote, because ‘it is unknown how many of the businesses might choose to locate here to avail themselves of this exemption.’”

House Bill 230 will be reviewed by the Kentucky Senate. The sponsors of the bill have noted in their submission that, with Kentucky’s low energy rates and its overflowing supply of said energy, the state has the makings of a cryptocurrency mining powerhouse in the United States.

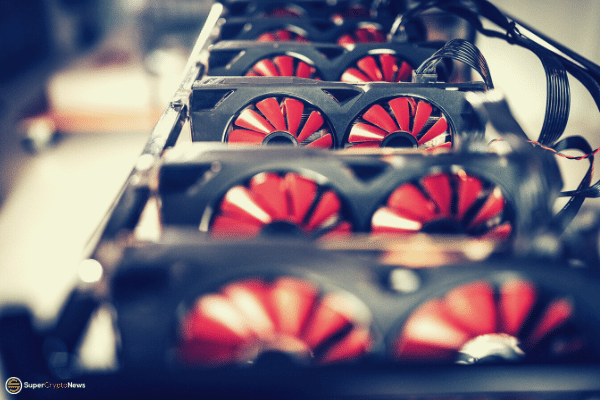

Once the bill has been ratified, it will be good news for the Kentuckian commercial bitcoin miners as they would not be paying 6% sales tax and 6% excise tax on physical personal property like mining rigs that are directly used in the process and the power supply used.

Some legislators were concerned about the amount of electricity that needed to be supplied to the mining operations. However, the advantage of attracting more industrial operations, backed with the recent growth of cryptocurrency, may be enough to make the bill worth ratifying.