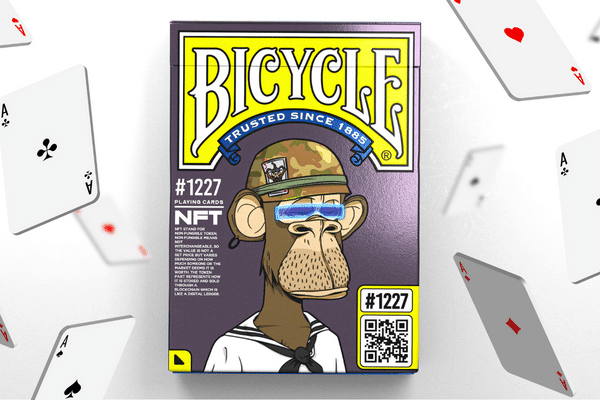

Late-night talk show host Jimmy Fallon is attempting to avoid involvement in the ongoing Bored Ape Yacht Club (BAYC) trademark case. Fallon’s legal team has submitted a request to dismiss a subpoena requiring his testimony in the Yuga Labs Inc. v. Ripps et al case, claiming that he has no relation to the dispute, is not a participant in the Ripps litigation, and has never encountered or interacted with the accused parties, media reports said.

Yuga Labs has filed a lawsuit against Ryder Ripps and Jeremy Cahen, alleging that they created an NFT collection that mimics their own, leading to trademark infringement, false advertising, and unfair competition.

Despite obtaining a Bored Ape Yacht Club NFT and discussing it on his program, Fallon has nothing to do with the ongoing case, according to the filing. Additionally, Fallon is a co-defendant with Paris Hilton in a distinct securities litigation case that involves Yuga Labs.

In other news, Getty Images has partnered with NFT platform Candy Digital to provide exclusive photographs in the form of NFTs. The collection includes works by photographers such as Don Paulsen and David Redfern, featuring iconic figures like David Bowie, Elvis, and The Rolling Stones.

Starting from March 21, Candy Digital’s website will offer the NFTs for purchase with prices ranging from $25 to $200. The release will be accessible to buyers in several nations, including the United States, the United Kingdom, and Japan. This collaboration comes as the NFT market shows signs of growth, with marketplace volume rising for the fourth consecutive month in February.

Forkast Labs, a data intelligence service created through the combination of Forkast.News and CryptoSlam, has established a set of NFT indices that offer immediate information on the digital asset economy. The Forkast 500 NFT index will monitor the performance of 21 blockchains, including Solana, Ethereum, Polygon, and Cardano, and is designed to serve as a representation of the entire NFT market. The indexes aim to offer a more comprehensive view of the state of the NFT economy, which is tough to gauge using traditional market rankings.

Finally, the NFT market is on the rise, with trading reaching a three-month high for the second consecutive day. According to data from NFT tracker CryptoSlam, over 125,000 trades occurred in the previous 24 hours. In February, the trading volume surged to over $2.04 billion, representing a 117% increase from January’s $941 million.

The primary factor behind this rise is the emergence of Blur as a maturing market, which has now exceeded OpenSea in terms of trading volume. In February, Blur’s trading volume rose to over $1.13 billion from the previous month, accounted for nearly all the NFT market’s month-over-month gains.