- A bipartisan bill which is gaining steam in the House could lead to a two-year moratorium on issuing so-called algorithmic stablecoins like TerraUSD.

- Under the latest version of the bill, it would be illegal to issue or create new “endogenously collateralized stablecoins” otherwise known as algorithmic stablecoins.

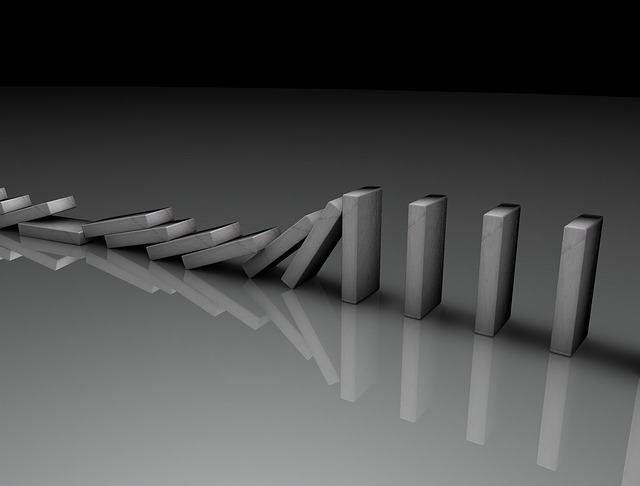

Even as algorithmic stablecoin creator Do Kwon remains at large, his ill-conceived creation is leaving a trail of wreckage in its wage.

The collapse of algorithmic stablecoin TerraUSD has already got the attention of high-ranking U.S. policy makers, including U.S. Treasury Secretary Janet Yellen, who in May said the incident “illustrates that this is a rapidly growing product and that there are risks to financial stability.”

But a bipartisan bill which is gaining steam in the House could lead to a two-year moratorium on issuing so-called algorithmic stablecoins like TerraUSD, which imploded in May and resulted in billions of dollars in losses as well as prompted policymakers to take renewed interest in stablecoins.

Under the latest version of the bill, it would be illegal to issue or create new “endogenously collateralized stablecoins” otherwise known as algorithmic stablecoins.

The bill is being crafted by Financial Services Committee Chairwoman Maxine Waters, a California Democrat, with the input of the ranking Republican on the committee, Patrick McHenry of North Carolina.

The bill, if passed, would also mandate that the U.S. Treasury Department, in conjunction with other financial regulators, draft a study on the threats and benefits of algorithmic stablecoins.

In addition, the legislation would direct the Fed to study the impact of a potential U.S. digital dollar – also known as a central bank digital currency – including the possible effects on the financial system and banking sector, as well as the privacy of Americans.

Algorithmic stablecoins work by maintaining a fixed peg against another token with a variable supply and demand.

Nation states have long struggled to maintain fixed pegs, as evidenced by the 1997 Asian Financial crisis, and artificial pegs are notoriously expensive to hold to.

That blockchain technology would solve what is essentially an intractable game theory problem is naïve at best.