The digital asset investment firm Grayscale has seen $217 million worth of investment inflow within a week after releasing a new TV commercial to the public on August 10.

Barry Silbert the CEO of Grayscale has announced that this was the largest fundraising week in the history of the firm. As the TV ad campaign aims toward traditional investors on large TV channels such as CNBC and Fox Business.

The new commercial tells a story of the evolution and development of money in various forms and finally introduces the digital currency as a new method of investment.

The influx of new money into Grayscale is a positive sign for the cryptocurrency market as traditional investors outside of the digital assets sphere have shown growing interests in this new asset class. In the Q2 of 2020 alone, Grayscale has reported the $900 million inflow of investors’ money into digital assets.

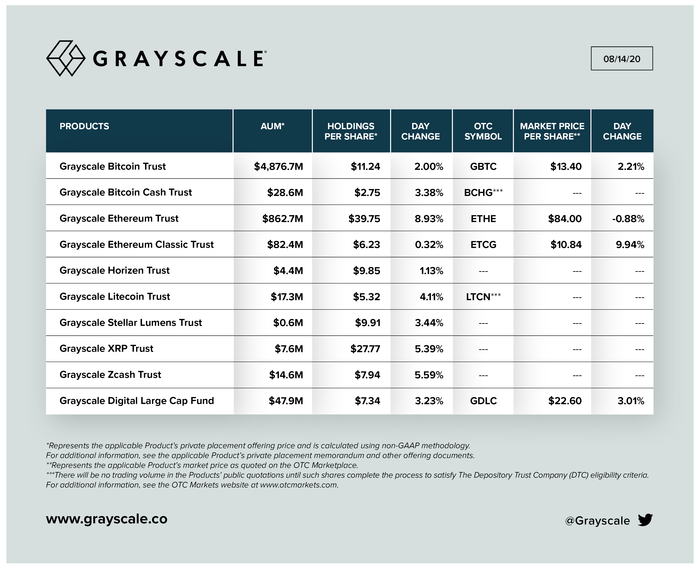

Currently Grayscale’s asset under management (AUM) is worth $5.9 billion. While the large part is being invested in the Grayscale Bitcoin Trust (GBTC) but there are growing demands for other Altcoins trust funds as the Ethereum Trust’s AUM is now worth over $860 million. Overall, the total AUM of Grayscale has increased more than $800 million in less than a month.

You may also want to read: FINRA Approves Shares of Grayscale Digital Large Cap Fund