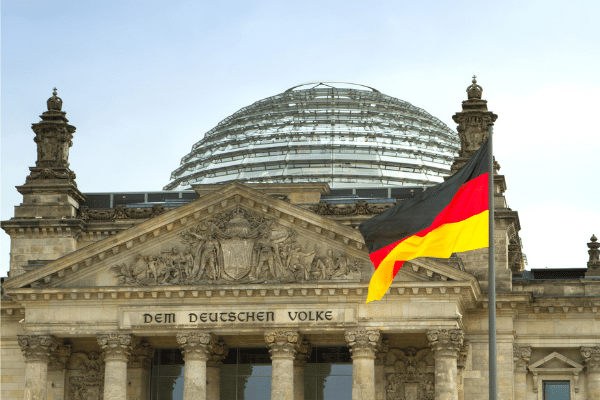

Germany, a prominent player in the European financial landscape, is slowly warming up to cryptocurrencies. While the embracing of cryptocurrencies by German banks has been gradual, there has been a notable shift towards acknowledging the potential of digital assets, particularly in catering to institutional investors, Veronika Rinceker, a Cointelegraph columnist, said in her latest post.

Historically, traditional financial institutions in Germany displayed caution and skepticism regarding cryptocurrencies. However, as the cryptocurrency market matured and gained mainstream recognition, German banks began exploring opportunities within this burgeoning sector. While their engagement remains cautious, the emerging trend suggests a growing acceptance and willingness to accommodate the demands of the evolving financial landscape.

German banks have primarily focused on catering to institutional investors in the cryptocurrency space. However, recognizing the increasing demand from this segment, banks have ventured into providing custodial services and investment vehicles for institutional clients to gain exposure to digital assets securely. By offering these services, banks expand their offerings and adhere to the regulatory requirements imposed by the German financial authorities.

Furthermore, several German banks have taken steps to establish collaborations with established cryptocurrency custodians and fintech firms. These partnerships enable banks to leverage the expertise and experience of specialized companies, facilitating a smoother transition into the cryptocurrency market. Such collaborations also allow banks to benefit from the existing infrastructure and regulatory compliance measures implemented by their partners.

Regulatory developments have played a significant role in shaping the approach of German banks toward cryptocurrencies. Germany has taken proactive measures to establish clear digital asset regulations, providing security and stability for financial institutions entering the market. In addition, implementing the Fifth European Anti-Money Laundering Directive (5AMLD) has also contributed to strengthening the regulatory framework, making it more conducive for banks to engage with cryptocurrencies, she argued.

Despite the gradual progress, challenges and concerns persist. Volatility, security risks, and the potential for illicit activities associated with cryptocurrencies remain apprehensions for many banks. Additionally, retail customers in Germany are yet to witness significant cryptocurrency integration within traditional banking services, indicating that mainstream adoption might still be some time away.