The crypto markets experienced a mixed day on April 5, with Bitcoin rising 2.6% to trade at $28,622 and Ether outperforming Bitcoin as it shot past $1,900 for the first time since August 2022, rising 5.5% from the previous day.

Other major cryptocurrencies were mostly in the green but with lighter gains. However, the previous day’s dramatic rise in Dogecoin following Elon Musk’s Twitter activity was short-lived, and the cryptocurrency was down 0.7% on Tuesday. Binance also suffered a loss of market share due to growing regulatory entanglements. The head of crypto research firm Delphi Digital’s markets division conveyed doubt regarding the future of Bitcoin, media reports said.

Against ongoing inflation concerns and a weakening economy, traditional safe-haven asset gold soared above $2,000, reaching its highest level since March 2022. After the U.S. Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) report revealed that job openings had dropped below 10 million for the first time in almost two years, this occurred.

A report showing a decline in durable goods orders. This economic decline and inflation concerns have created a favorable environment for more conservative assets that hold their value.

Oanda’s analyst advised investors to pay attention to Bitcoin’s price as the Labor Department released nonfarm payroll figures and the end of a Good Friday-shortened working week approached. He also noted that Bitcoin’s price had a significant barrier at the $30,000 level, and if the NFP report on Friday surprises negatively, high-frequency trading systems and algorithms could take advantage of any momentum opportunities.

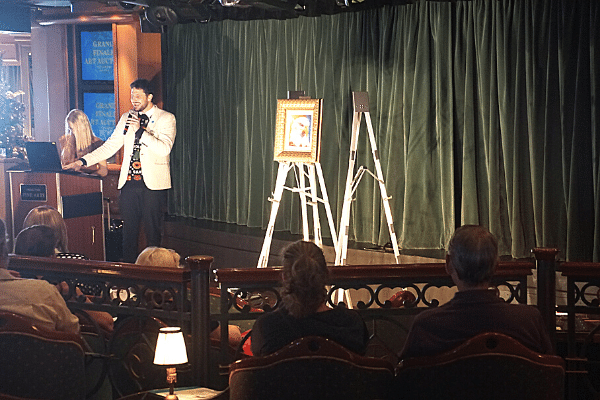

Finally, Alex Thorn, head of firmwide research at Galaxy, will speak at Consensus 2023 on “Bitcoin and Inflation: It’s Complicated,” offering insights on how Bitcoin can navigate the challenges posed by inflation. The cryptocurrency community is eagerly anticipating his perspective.