Cryptocurrency trading via derivatives is an infallible way to earn returns from your investments. You can make amplified trading returns by hedging your investment against the volatility prevalent in the crypto markets and using leverage. One of the leading derivatives exchanges, Delta Exchange, offers the best way to grow your assets via their Delta Invest feature.

Under the Delta Invest feature, users can ramp up their returns

(i) using yield strategies or

(ii) put their investments on autopilot using Delta Exchange’s Robo trading Strategies or

(iii) simply stake their tokens in any of the four liquidity pools active on the exchange to earn attractive yields.

Before we jump into the practical bit on ‘how to Invest,’ let’s discuss a bit about each of the strategies Delta Exchange has on offer.

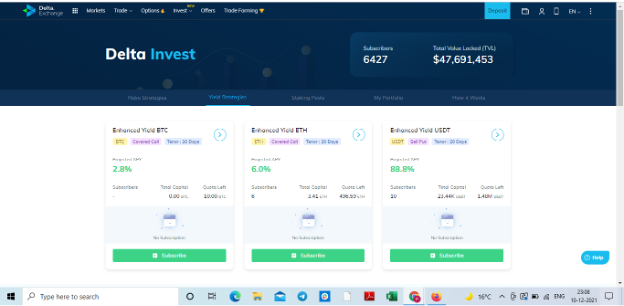

Yield Strategies at Delta Exchange

Yield strategies or yield farming operate on the principle of ‘more returns with your existing crypto’ and are prevalent in the DeFi landscape. Using different strategies, users or ‘yield farmers’ lend out their crypto assets to earn passive income. These strategies might include arbitraging, lending, providing liquidity, and margin trading.

Yield farming via crypto options includes covered calls where the investor sells call options equivalent to the amount of the crypto asset already owned by them. This strategy is suitable for investors who want to HODL their crypto assets for a longer period of time. These calls are neither bullish nor bearish in nature.

Delta Exchange currently offers three kinds of yield farming strategies: Enhanced Yield BTC with a projected APY of 2.9%, Enhanced YIeld ETH with a projected APY of 6.6%, and Enhanced Yield USDT with a projected APY of 82.3%.

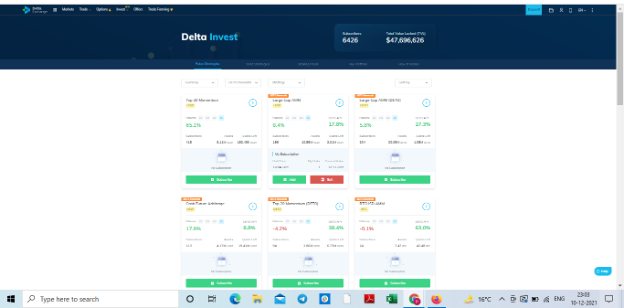

Robo Trading with Delta Exchange

Robo trading is another innovative avenue offered by the exchange for investors who want to automate their investments. It is a form of automated crypto trading where users can deploy their capital and let the trading bots do their work. Delta Exchange has several robo trading strategies on offer where each aims to maximize the profit in the form of USDT usually. The three broad categories of robo trading include:

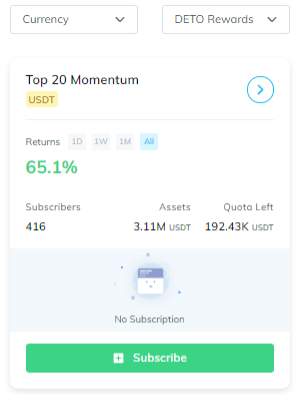

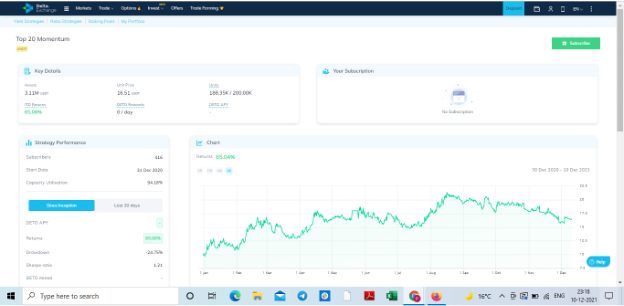

Momentum Strategy: Under this strategy, a trader can go long on positions that look on the rise and go short on positions that seem to be losing steam. Delta offers three kinds of Momentum strategies, namely, Top 20 Momentumwith a return of 64.3%, Top 2 Momentum with a return of 18.4%, and Defi Momentum with a return of -31.8%.

AMM(Automated Market Maker) Strategy: It seeks to capture a dynamic price that traders are willing to pay over the fair price for liquidity. Delta Exchange offers a Large Cap AMM strategy where the provision for both bids and offers to the order books of BTCUSDT and ETHUSDT contracts listed on the exchange is made. The APY of Large Cap AMM(USDT) is 8.3%, while Large Cap AMM(DETO) is 5.8% currently.

Arbitrage Strategy: This strategy aims to capitalize on the price differential between two markets – derivatives and spot market – while earning a premium for the same. Delta Exchange currently offers the Cash Future Arbitrage Strategy to capture a premium by capitalizing on the price differential between BTC and ETH futures and their respective spot markets.

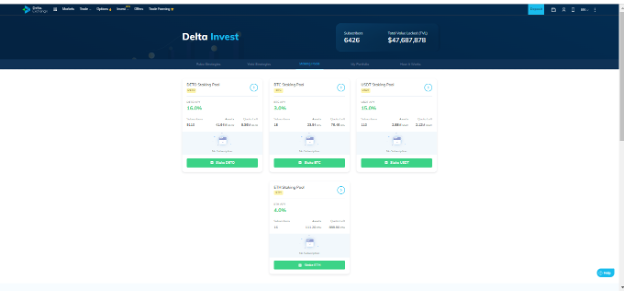

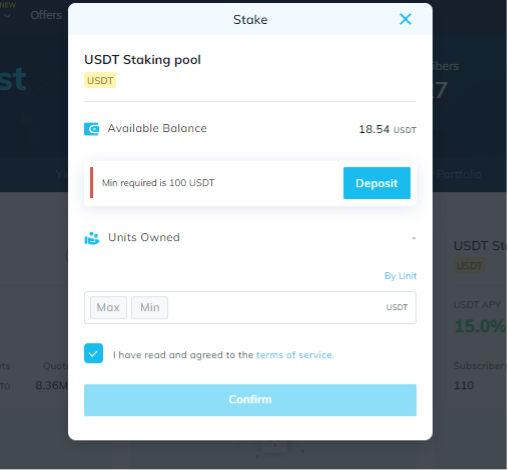

Delta exchange offers Staking pools to investors to earn additional passive income.

How to begin your Investing Journey with Delta Exchange?

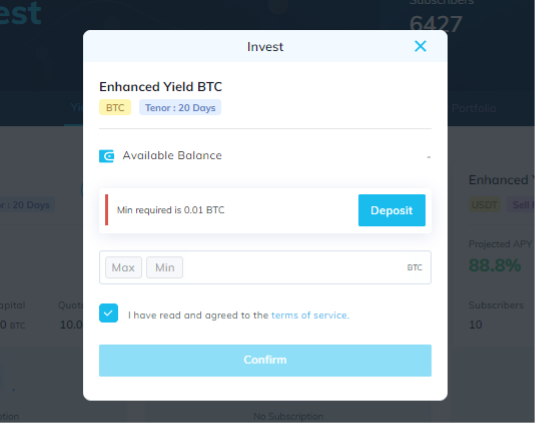

Delta Exchange has a three-step fundamental to proceed with any strategy and staking in liquidity pools under its Delta Invest feature.

- To begin investing, All you need is to select a strategy in which you want to rake in your investments.

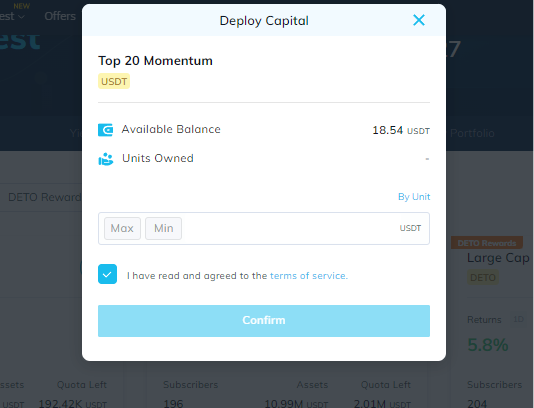

- The next obvious step is deploying the capital. Make sure you have the minimum balance required to proceed to invest.

- Confirm your subscriptions and watch over them regularly under the ‘Your Portfolio’ tab, where you can view all your investments together, scroll through their markets and gauge their performance via market charts updated in real-time.

#1 How to Invest in Yield Strategies?

#2 How to Invest in Robo Strategies?

#3 How to Invest in Staking Pools?

What are you waiting for then? Start investing with Delta exchange’s Delta Invest – the best strategies to grow your investments via yield farming and robo strategies.

[Editor’s Note: This is a paid article placement]