After Ethereum’s rally to its ATH of US$1,700, large and successful DeFi projects have seen their tokens skyrocketing one ATH after another.

In terms of percentage rise, the DeFi tokens beat the current over-hyped Bitcoin rally hands down/

ChainLink has seen its token price appreciate from US$8 back in December 2020 to more than US$26 as of this writing. This is more than a 300% increase within a two month period.

Similarly, the world’s largest decentralized cryptocurrency exchange, UniSwap, has also enjoyed an explosive growth from around US$3.50 to its current ATH of more than US$20. This is a near whopping 500% increase.

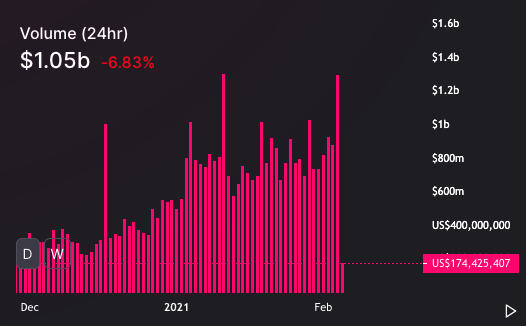

For UniSwap, their daily transaction volume has been hitting US$1 billion on several days since the start of 2021. Liquidity has also reached ATH of nearly US$4 billion.

(Liquidity chart taken from UniSwap.org on 5th Feb 2021)

(Daily volume chart taken from UniSwap.org on 5th Feb 2021)

Decentralized exchanges will usher in the next wave of trading platforms whereby tokens can be listed and traded without a central authority. At this rate of growth, it would not be surprising to see UniSwap liquidity hits US$5 billion soon.

Other UniSwap spin-offs like SushiSwap has also seen its token price skyrocket.

However, not all DeFi projects are enjoying the same astronomical growth like UniSwap and Sushi. Yearn.Finance, one of the pioneer in DeFi, is just up roughly 50% from December 2020.

Regardless of the respective DeFi token price movements, it is undisputed that DeFi will soon eat some of the lion’s shares of traditional banking services. One of the first pie would be the lucrative loan market.