The effects of the “Black Thursday” sell-off in March as a result of fears stemming from the global spread of COVID-19 virus lingered well into April, as all asset classes saw a fair share of hits in the weeks after.

Almost two months have passed since then and the virus is now under control in some regions. Some assets have seen strong recoveries, and yet, some still struggle below pre-crash levels. At the moment, there is no doubt that the two best-performing assets are gold, and its digital counterpart, Bitcoin.

Coinbase’s latest report shows that Bitcoin has now taken the lead from gold in terms of year-to-date (YTD) returns. At the moment of writing, Bitcoin stacks 20% YTD, and gold follows closely at 12% YTD while stock indices such as S&P500 still cannot breach the surface with -10% YTD.

Bitcoin and gold are considered by many as safe-haven assets in difficult times, such as the current global pandemic. They both benefited from an excess in liquidity when central banks around the world are injecting large sums of money into the system, in the hopes of keeping the economy above water. This is of paramount concern, as some investors have voiced their disapproval over the unprecedented amount of stimulus, mostly printed out of thin air, and it could have a mid to long-term effect on the devaluation of US dollars.

Real sectors across the globe are still in the dark while a majority of businesses remain closed, with citizens forced to stay home under lockdown. Equity markets might have seen decent recoveries but most are still far below pre-correction levels. Oil prices are at their lowest points in decades, suffering from stagnation in demand. Physical gold bar deliveries are facing problems as supply chains have come to a sudden stop, which have caused irregularities in prices between the New York and London gold markets.

Bitcoin, however, received little to no damage from the global lockdown since its operations are done across a web of decentralized networks and the Internet. In fact, the trend of contactless and cashless payments are more likely to boost the adoption of Bitcoin and other modern online payment methods.

The recent test-run of China’s digital yuan or DC/EP and Libra’s whitepaper overhaul are wake-up calls for governments and people around the world to realize that the digital era of finance is taking place.

Simply put, gold will remain to uphold its role as a store of value as it has been doing for thousands of years. However, Bitcoin is more lucrative with the integration of technology and featuring properties which are more suitable for the digital era.

Price Analysis: Bitcoin (BTC)

During the March 12-13 sell-offs, Bitcoin prices took a nosedive, declining to a price level not seen in 10 months. Buyers stepped in quickly and bought the discounted BTCs as it bounced firmly from the red supporting trend-line. Since then, for 7 consecutive weeks, Bitcoin has been in a slow but steady upward trend before breaching the pre-crash level at approximately $8,000.

In the short-term, Bitcoin’s upward spike to test the declining trend-line (light blue) at around the $9,400 range failed, resulting in a price pullback to sub $9K levels once again. If Bitcoin manages to break above the light blue line, there is a bigger timeframe’s downtrend (in red) of resistance looming above. There is hope for BTC to reach a new all-time-high (ATH) if prices smash through the red trend-line, but do not expect this to happen anytime soon without any substantial buying volume.

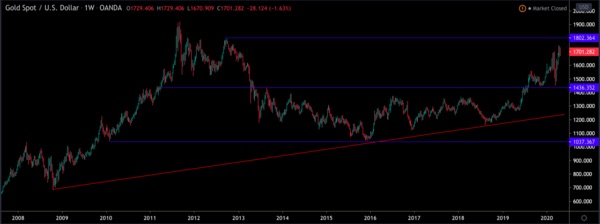

Price Analysis: Gold

Since 2013, gold reached a low at $1,037 and has traded in a sideways manner for 6 years before finally breaking above an important resistance level at $1,436 at the end of 2019.

2020 seemed bright for gold as it attempted to reclaim $1,700 level, before the COVID-19 crash dragged the price downwards to retest its previous resistance at $1.4K. This level eventually turned into a new support level.

At the beginning of April, gold managed to mark a multi-year high at $1,747 and is now consolidating at the $1,700 level. The next target for gold would be $1,800. If it gains a strong foothold at this level, then it might have a shot at creating a new ATH above $1,924.

You may also want to read: Why $9,000 is Such a Formidable Resistance for Bitcoin?