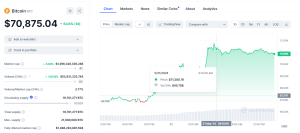

Bitcoin (BTC) staged a dramatic comeback after a quiet weekend, rocketing past $72,000. This surge follows a period of consolidation around $67,000, which finally gave way yesterday evening.

Source: CoinMarketCap

The rally extended to other major cryptocurrencies, with Ethereum (ETH) leading the charge. Fueled by renewed optimism surrounding a potential US approval of Ethereum ETFs this week, ETH surged over 20% to reach a multi-month high above $3,700.

This rapid price movement triggered over $260 million in short liquidations across major exchanges, marking the highest level since February. Notably, over $115 million in Ether shorts were liquidated, highlighting the vulnerability of bearish bets in this climate.

The surge in Bitcoin coincides with a six-day streak of inflows into Bitcoin ETFs, reaching nearly $240 million on Monday. Analysts believe the potential approval of an Ethereum ETF could have a similar impact, attracting institutional capital and driving prices even higher. Some analysts, like Singapore-based QCP Capital, predict ETH could reach $4,000 if the ETF is greenlighted.

The potential for ETF approval has some traders anticipating further price increases for ETH. Singapore-based QCP Capital predicts a potential rise towards $4,000 if approved, with a possible dip back to $3,000 if rejected.