Crypto.com released its Consumer Spending Insights Report for 2020, which details spending trends and data for its Visa Card—the most widely-available card of its kind in the world.

The first look into spending trends for the Crypto.com Visa Card, the report found that overall spending per user in 2020 grew 55% YoY, with a 117% increase in online spending relative to overall spending growth, notably for the categories of housing, household goods, groceries, and cross-border transactions.

Cardholders shopped with merchants in 143 countries, nearly half of which are in the U.S. (24%) or in the UK (23%). The report reveals strong overall growth for the card, and significant changes in user spending habits resulting from the pandemic.

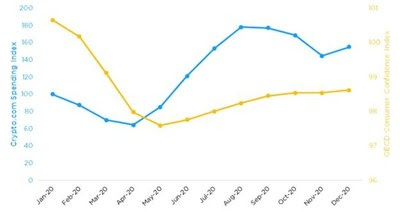

As the pandemic began spreading globally early last year, spending with the Crypto.com Visa Card followed a similar trajectory to the OECD’s Consumer Confidence Index (see chart below), with drops in both occurring in the first four months of 2020. As consumer confidence returned (yellow line), Crypto.com Visa Card spending per user (blue line) recovered quickly, ending the year with 55% more spending than 2019.

Kris Marszalek, Co-founder and CEO of Crypto.com said: “As our Crypto.com Visa Card availability continues to expand globally, so too are the ways in which people are using it. This granular spending data gives tremendous insight into where, how, and for what purchases the card is being used globally, and reveals significant spending behavioral changes driven by the pandemic. We’re excited by the diversity of transactions shown in the data, as crypto continues its mainstream push and as we continue to expand what is already the most widely available card of its kind into more markets.”

First introduced in Singapore in 2018, the Crypto.com Visa Card is the largest Visa card program of its kind, and is currently available in the U.S., Canada, 31 countries in Europe, and the APAC.

Last month, Crypto.com expanded its partnership with Visa, which granted the company Visa principal membership. This new partnership enables Crypto.com to begin direct issuance of its card in Australia, and allows the company to have a direct relationship with cardholders.

Crypto.com plans to scale its card program to many more markets around the world, and began offering virtual cards in Europe this month, so users can start spending without waiting for their physical cards to arrive.