CMCC Global, A crypto-focused venture capital firm based in Hong Kong, has secured $100 million for a newly launched fund aimed at supporting startups in Asia’s blockchain sector.

The Titan Fund, as reported by the South China Morning Post, has garnered support from over 30 investors, including notable names such as Winklevoss Capital and Yat Siu, the founder of Animoca Brands, media reports said.

Block.one (B1) emerged as the lead investor, committing $50 million and also becoming a minority shareholder in CMCC Global’s holding entity.

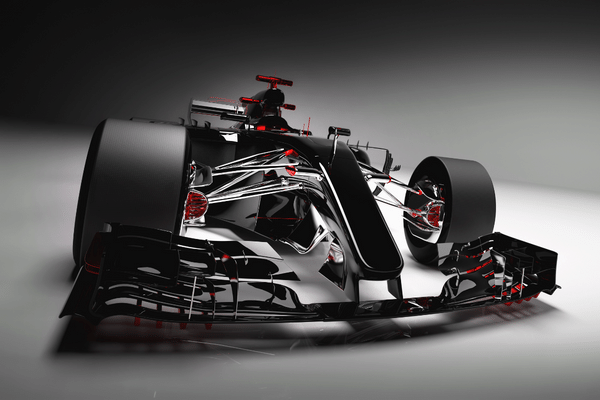

The fund’s strategic focus encompasses three key investment categories: blockchain infrastructure, consumer applications, and crypto financial services.

Co-founder Martin Baumann expressed optimism about supporting entrepreneurs venturing into the evolving web3 space in Hong Kong.

He stated, “If Hong Kong continues on its route of embracing web3, there will naturally be more and more entrepreneurs starting companies in that space, and we can be their first capital.”

The fund’s announcement coincides with Hong Kong’s resurgence in the crypto domain. Historically housing crypto giants like BitMEX and Alameda Research, the city is reportedly collaborating with China to position itself as a potential breeding ground for new crypto innovation.

In a notable move in August, licenses were approved for HashKey Exchange and OSL to offer crypto trading services to retail traders in Hong Kong.