- According to Caixin, a Chinese new site, hundreds of contractors say they themselves can no longer afford to pay their own bills because developers, including China Evergrande Group, still own them money.

- Although Beijing has urged banks to boost lending to help builders complete their projects and are said to be mulling measures to provide grace periods on payments for homebuyers, bigger monetary policy moves have so far been lacking.

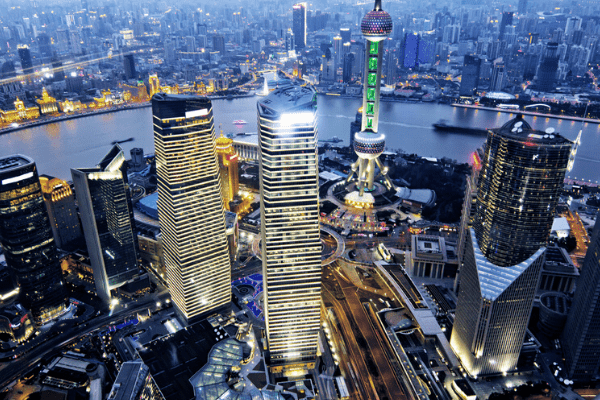

If China Evergrande Group’s bond defaults were the first signs of a crack in the dam of China’s economy, then that crack has since developed into a fault line which threatens to take down a significant portion of the world’s second largest economy with it.

As more homebuyers default on their mortgages – the contagion has now spread to 91 cities where disgruntled buyers have refused to pay their mortgages on stalled developments – builders and contractors are now stiffing banks on their loans as developers fail to pay up.

Because developers are struggling to access credit, especially on global bond markets where even the sturdiest players are offering exorbitant yields with few takers, many aren’t able to complete their projects or pay contractors.

According to Caixin, a Chinese new site, hundreds of contractors say they themselves can no longer afford to pay their own bills because developers, including China Evergrande Group, still own them money.

The repercussion of cascading defaults threatens to derail China’s economy where as much as 29% of GDP is related to the real estate sector and 70% of the overall economy is affected by the fortunes of a once thriving industry.

Homebuyers defaulting on their mortgages and contractors stiffing the banks on theirs comes at the worst possible time for Chinese President Xi Jinping, who is looking to install himself for a third term as president, and then possibly leader for life.

Bailing out some of the country’s real estate developers could exacerbate threats of non-payment by those who didn’t receive relief, while bending to demands for support would necessarily put a strain on state finances, at a time when Xi needs stability.

Although Beijing has urged banks to boost lending to help builders complete their projects and are said to be mulling measures to provide grace periods on payments for homebuyers, bigger monetary policy moves have so far been lacking.

Part of the problem of course is that China is heavily dependent on foreign imports of raw materials, especially oil, which is denominated in dollars.

As the greenback strengthens, it becomes hard for China to cut interest rates aggressively as a weak yuan, whilst helping exports, would hurt China’s ability to import the raw materials that it so desperately needs to power its economy.

Separately, overstocked retailers in the U.S. mean that even though Chinese imports are cheaper, demand in the U.S. has been lower and is likely to be in the coming periods.

Europe, another major destination for Chinese wares, is also in the throws of a major economic slowdown because of soaring energy prices, in particular natural gas, as well as the European Central Bank being forced to walk up interest rates, as the euro slips below the dollar for the first time ever.

Although Chinese lenders have put on a brave front, they are sitting on massive exposure to borrowers with some US$5.7 trillion of outstanding residential mortgages and US$1.93 trillion loaned to China’s embattled real estate developers.