Chinese authorities have arrested 21 people in the northern province of Shanxi for allegedly engaging in a USDT money laundering conspiracy. The total amount laundered is reported to be over US$54 million. The Hong Kong-based subsidiary of iFinex Inc., Tether Limited Inc., issues USDT. This stablecoin is asset-backed and linked to the U.S. dollar, media reports said.

The accused reportedly used over-the-counter crypto trading services in four different provinces. They began acquiring USDTs at a discount in October 2021. The police investigations suggest that the defendants resold the tokens on social media and money-laundering websites at higher rates. Consequently, they made illegal profits. The total amount of these transactions over approximately three years was over 54.8 million USDT. This amount is equivalent to about CNY380 million.

During the arrest, the authorities confiscated 40 mobile phones. They also seized about 1 million yuan (around $138,000) in USDTs from the suspects’ accounts. Additionally, they took more than 200 thousand Yuan in cash. All 21 suspects have reportedly admitted to the charges. These include assisting hackers in converting the Chinese yuan to USDT. However, China Central Television (CCTV) reports that the case is still under investigation.

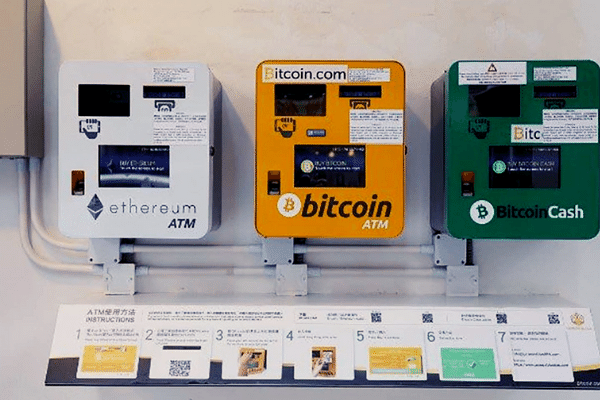

CCTV also reports that police have found USDT to be the preferred cryptocurrency for money laundering operations. Despite China’s 2017 ban on cryptocurrency issuance and 2021 prohibition on crypto transactions, Chinese residents can still access cryptocurrencies. They use decentralized finance (DeFi) networks and proxy internet servers.

This case is a stark reminder of the potential misuse of cryptocurrencies. It underscores the need for robust regulatory frameworks to prevent such illegal activities. Moreover, it highlights law enforcement agencies’ challenges in tracking and prosecuting such crimes.

The case also raises questions about the effectiveness of China’s stringent cryptocurrency regulations. It remains to be seen how this case will influence China’s approach to regulating cryptocurrencies in the future.