- Inner Mongolia, which is estimated to be responsible for around 8% of the Bitcoin mining activity, is set to ban cryptocurrency mining

- Move by Inner Mongolia regional authorities has sent the price of Bitcoin spiking, but most cryptocurrency activities for the Chinese tend to be located offshore anyway, with the exception of mining

Because I never launched an ICO

Because I was trading on decentralized exchanges

Because I was not a miner

Given that China is estimated to be responsible for around 65% of the world’s Bitcoin mining capability, the ban by China’s Inner Mongolia region, which is home to substantial Bitcoin mining facilities, immediately sent Bitcoin’s price higher.

The ban is expected to kick in next month, with Inner Mongolia looking to ban cryptocurrency mining by the end of April.

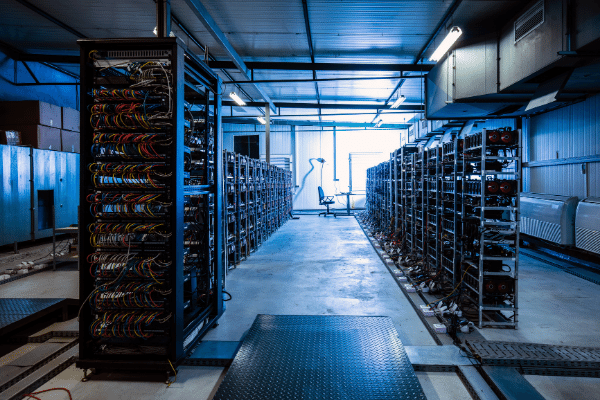

Inner Mongolia is particularly favored by cryptocurrency miners because of its abundance of cheap power, with the stated aim of the ban on cryptocurrency mining to constrain growth in energy consumption to about 1.9% this year.

China has always been the elephant in the room when it’s come to cryptocurrencies, with Beijing vacillating from looking the other way on the industry, to harsh crack downs, amid concerns over speculative bubbles, fraud and energy waste.

Inner Mongolia’s draft policy banning cryptocurrency mining comes just weeks after the province was blasted for being the only region to fail to control energy consumption in 2019.

Beijing has made the management of climate change a key development priority and unfortunately for cryptocurrency miners in Inner Mongolia, the bulk of its power is generated by highly pollutive coal-fired power stations.

But it’s hardly just cryptocurrency mining that has contributed to power consumption in Inner Mongolia – the region is famous for cheap energy and has attracted investment from a plethora of power-hungry industries, including aluminum and fero-alloy smelting.

Inner Mongolia also accounts for some 8% of global Bitcoin mining computing power, according to the Bitcoin Electricity Consumption Index, compiled by Cambridge University.

The local crackdown on cryptocurrency mining is reviving old fears that Beijing may pick up the gauntlet and go on another purge of the industry.

Beijing banned initial coin offerings in 2017 and banned cryptocurrency exchanges within its borders shortly thereafter.

Once home to as much as 90% of cryptocurrency trading, the bulk of mining, including the likes of Bitmain Technologies, one of the biggest makers of cards specifically for the cryptocurrency mining business, have since fled offshore.