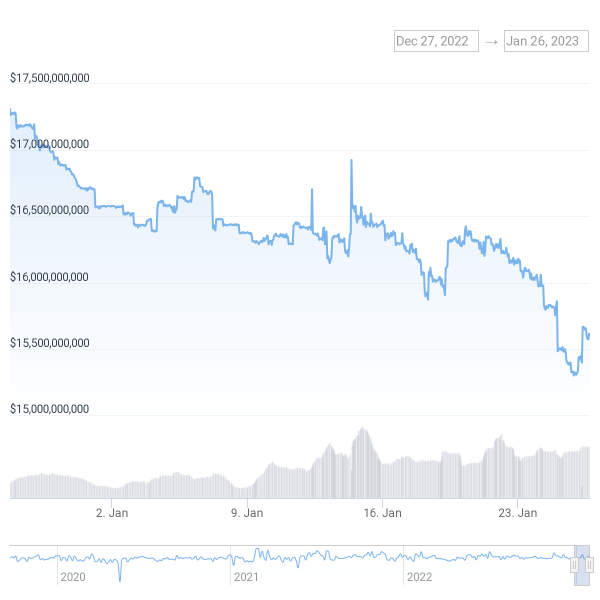

As the crypto market continues to experience volatility, the value of Binance USD (BUSD), the Paxos-issued stablecoin, has fallen to below $10 billion for the first time since June 2021. This decline is due to a rapid drop in demand following Paxos’ announcement on February 13 that it would stop issuing new BUSD tokens in the light of directives to this effect from NYDFS. News reports said the U.S. Securities and Exchange Commission (SEC) is also planning to sue Paxos for offering unregistered securities.

Coinbase has announced that it will temporarily suspend trading of BUSD on its platform from March 13 due to liquidity concerns. The decision comes in response to the decreased demand for BUSD in recent weeks. BUSD had an average day-to-day trading volume of around $9 million on Coinbase during the past two months. With a market depth within 2% of the market price of only $600,000, the stability of the stablecoin’s price was at risk of being affected.

According to blockchain data by crypto intelligence firm Nansen, despite the decline in BUSD’s value, investors have been redeeming some $6.7 billion of BUSD from Paxos since February 13. This has resulted in dogecoin (DOGE) replacing BUSD as the ninth-largest cryptocurrency by market capitalization.

The liquidity concerns surrounding BUSD have prompted discussions around developing new crypto-linked investment products in a bear market. Speaking on the matter, Jenny Johnson, the President and CEO of Franklin Templeton, discussed the mood among her clients and her long-term view of crypto. She emphasized the importance of developing products that allow for greater access to the crypto market while mitigating risks, particularly during market downturns.

While BUSD’s liquidity concerns persist, the overall crypto market has remained volatile, with Bitcoin (BTC) trading at $22,356.41, up 0.07%, Ethereum (ETH) trading at $1,568.58, up 0.06%, Binance Coin (BNB) trading at $290.43, up 0.24%, and Ripple (XRP) trading at $0.37632205, up 2.73%. Additionally, Aptorum Group (APT) trades at $11.55, up 2.00%.