In two or three years, you’ll feel silly about ever worrying about bitcoin at $50,000. You’ll think about it the same way you think about bitcoin at $5,000:

“I wish I’d bought more.”

One day, bitcoin’s price will go way higher than $50,000.

Today, the market is very risky.

Based on data and patterns from the entirety of bitcoin’s history, we are now seeing the same things we have always seen as bitcoin approaches a market cycle peak or a very significant crash.

When I say “significant crash” I don’t mean the 20% drop we just had. I mean a gut-wrenching, faith-shaking decline.

Long-time hodlers, OGs, and whales are shipping off their bitcoin at an accelerating rate. Miners are selling at an elevated pace. HODL waves show bitcoins moving from strong hands to newcomers. Price ratios like MVRV Z-Score and Puell Multiple are getting close to their danger zones.

I shared this data and more in the February 25, 2021 update for subscribers of my newsletter, Crypto is Easy, and will repost just a few nuggets here.

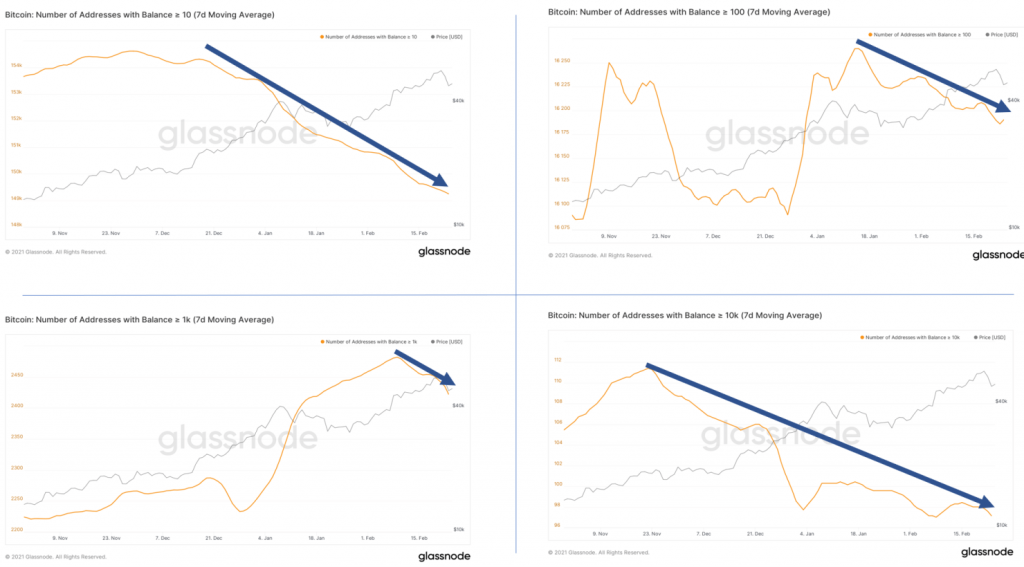

From big to small

The number of wallets with more than 10,000, 1,000, 100, and 10 bitcoins dropped this month. In the case of 10 and 10,000 BTC holders, those numbers have gone down since November. Take a look:

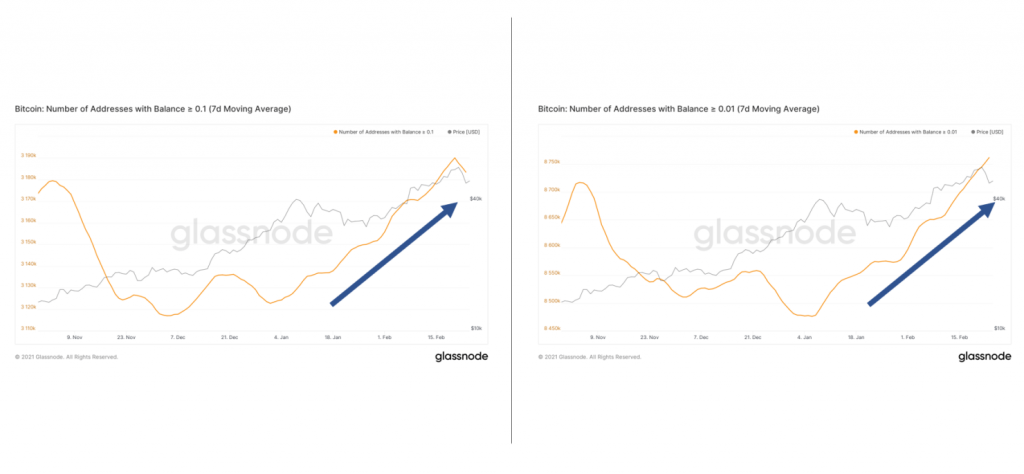

Meanwhile, the number of wallets with small amounts of bitcoin went up during that time.

There could be a few reasons for this, but with the same result: bitcoins are moving from big accounts to small accounts.

Perhaps institutions and custodians split their bitcoin holdings into a bunch of $500 – $5,000 wallets? Maybe the whales are doing something sinister? Multisigs? Miners paying workers?

While those are all possibilities, it’s probably big HODLers, OGs, and some institutions selling their bitcoin to new or small buyers.

Miners seem to have gotten in on the act, too. Miners’ position index has crept higher and higher since December, suggesting miners have started to sell at a faster pace than they did in 2020.

In other words, the biggest believers and most committed bitcoiners are giving up their bitcoin.

What about Grayscale?

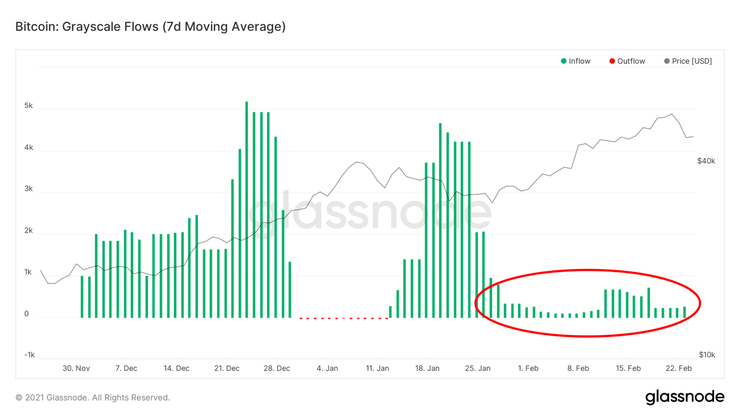

Grayscale’s February data show a drop in total inflows, circled in this chart:

Since you can’t move Grayscale’s bitcoins to private wallets, we know these changes do not come from investors moving bitcoins from GBTC to their HODL wallets. Either lots more people sold their shares OR less money’s coming in now than before. Possibly both.

That drop-off did not get picked up by the new Canadian ETF, which saw flows over its short lifespan fall from 2,251 bitcoins to 417 bitcoins in its first week. Based on CryptoQuant data, 3iQ did not buy any bitcoins in February.

Those are three of the biggest funds, and they’re not growing nearly as fast as they did before.

This signals diminishing interest among accredited investors and investment accounts, at least temporarily.

But the HODLers!

I’ll get to that below. Keep in mind, hodlers don’t drive prices up, they only set the floor for how far prices fall. Eventually, you run out of sellers.

But you still need buyers. We can still shoot up to a big “blow-off” top and crash 80% or more afterward–or just crash from here–even if all the HODLers HODL.

Past is prologue?

We see lots of coincidences in today’s data compared to what we saw as the market approached its previous market cycle peaks.

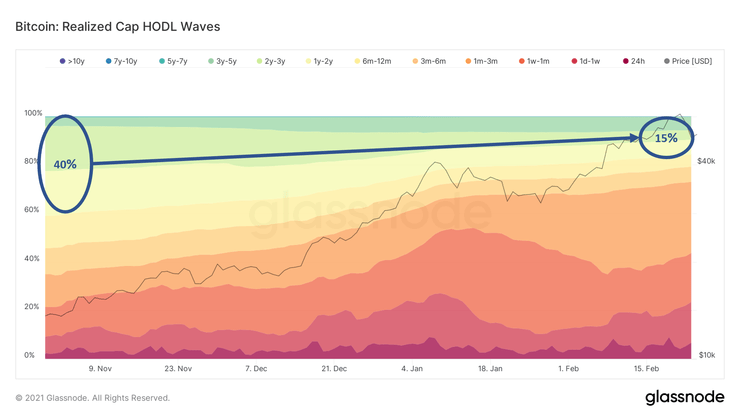

Looking at realized cap HODL waves, which account for the market value and influence of different HODLer wallets on the market, you can see long-term hodlers have left the market over the past few months.

From November to today, they’ve gone from holding 40% of bitcoin’s value to only 15% of that value. Look:

These are the strong hands getting rid of their bitcoins.

When else do we see this?

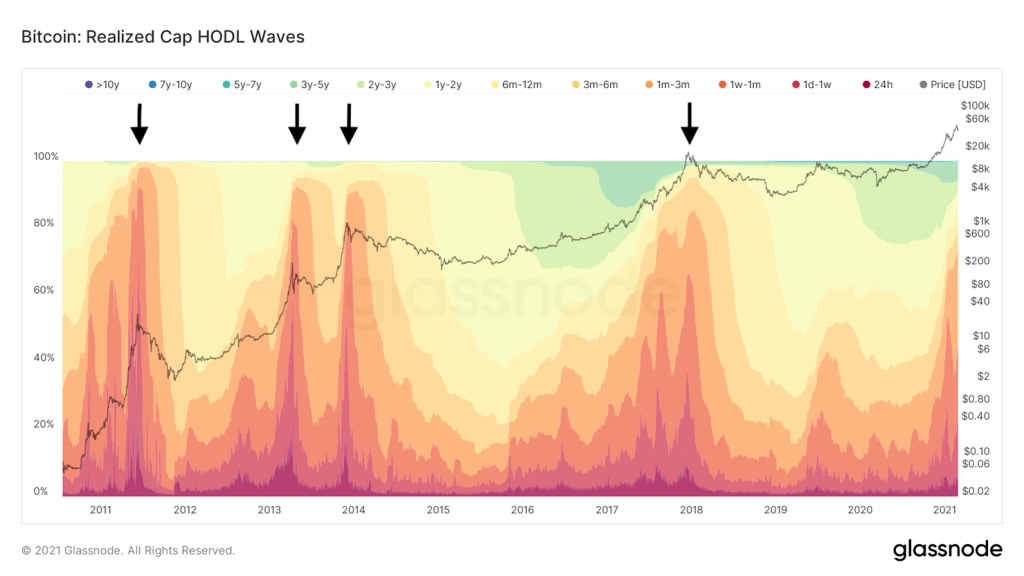

As we approach market cycle peaks. Look at the HODL waves over the entirety of bitcoin’s history. You only see the top bands shrink like this as the market approaches its peak, shown as black arrows in this chart:

As of this post, we’re not quite at the levels that match our previous market cycle peaks, but we’re not far off.

If new buyers start hodling, we will see that action reflected in the HODL waves. The lower waves will smooth out as bitcoins flow to the middle waves. Gradually, the middle waves will widen, then the upper waves will, too.

We saw a little of that towards the end of January, but that pattern has now reversed.

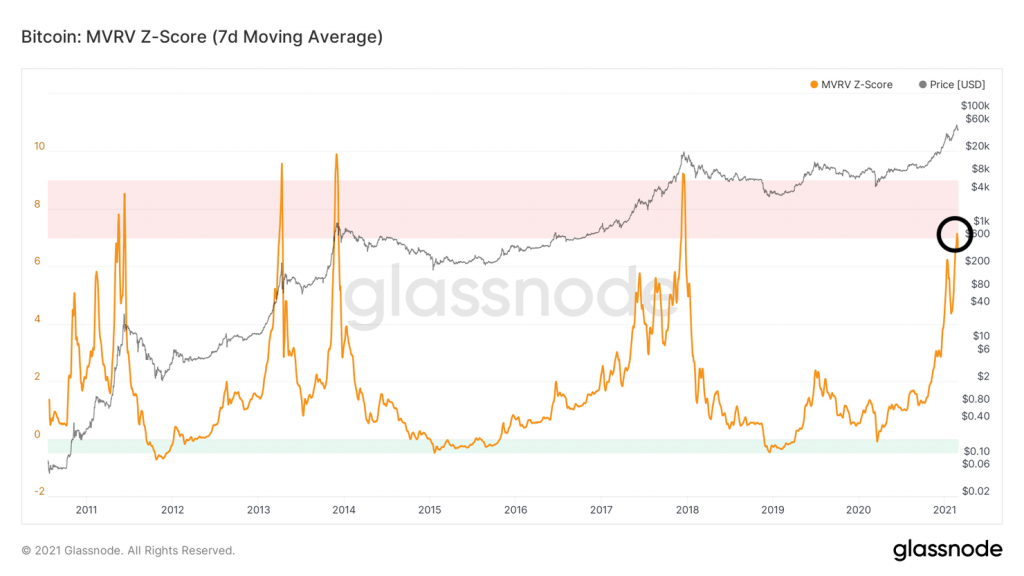

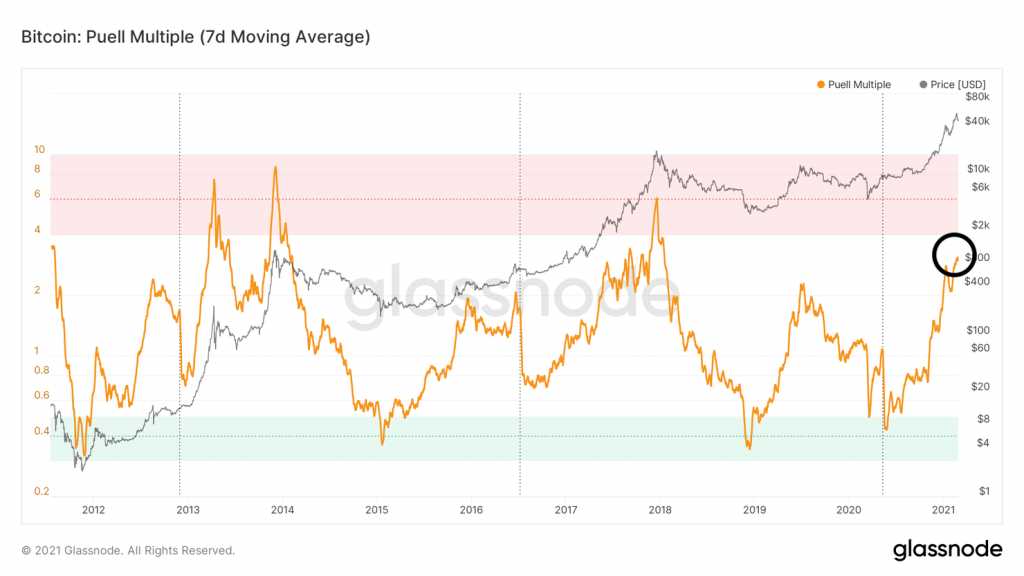

Worse, classic top-finding metrics MVRV Z-Score and Puell Multiple have gotten dangerously close to extremes. Take a look at where we are, circled below:

Why are those top areas shaded?

Because these metrics drift into those zones ONLY when the market gets near its peak.

Wall of Money, Mark. WALL. OF. MONEY.

I know. There’s a wall of institutional money waiting to enter.

I heard the same thing about Wall Street in 2017. Guess what? Wall Street did enter. En masse.

But they did it in 2018 and 2019, after the market cycle peak, when they could buy for pennies on the dollar, not in the middle of a parabolic boom.

Maybe institutions will put their money into bitcoin instead of income- and growth-producing activities. We’ll see.

To get a hyperbitcoinized super-cycle, you’re betting on businesses and institutions sitting on massive gains for a long time or pulling money out of productive, profitable, long-term development.

We’ve never seen humans or institutions do that with any asset.

Even the true believers capitulate when prices go up. When bitcoin’s price hit $40,000 and again at $57,000, OGs, influencers, and so-called maximalists took profits.

At least, that’s what they told us they did.

If the true believers take money out of the market as prices go up, what makes you think institutions won’t?

Mark . . . are you saying mean the bull market’s over?

No.

If anything, this data suggests we’ll reach the end of this market cycle soon. Hard to imagine when bitcoin’s price has fallen 20% in one week, but the data doesn’t lie.

Still, you may want to keep some fresh cash handy and start thinking about what you’ll do if we don’t get that result. Maybe you miss the 2-4x pop we get on the way up to the peak, but you can get your money in after the inevitable 70-80% crash that comes afterward.

Consider the alternative interpretation of this data: we’re in for a pretty significant crash, far more than this past week’s dip. What if we get an extended +50% decline that lasts for months, as we did in 2020 and 2019? THAT is when you will want to buy bitcoin.

So . . . what to do now?

Nothing.

Sure, you can put more money into the market. Long-term, it won’t matter. At some point, bitcoin’s price will go way higher than $50,000. Some altcoins will do far, far better.

My point is not to make you buy or not buy bitcoin or any other cryptocurrency.

My point is to point out the risks that nobody else is talking about. This data conflicts with the growing narrative that price can go “only up” forever.

For that reason, I’m chilling and waiting to see what happens. This market could crash 80% before my portfolio goes into the red. If you followed my plan, you’re in the same situation—way up on your investment, looking forward to whatever comes next.

I’m not taking money out until I see the “sell” signals in my plan. Likewise, I’m not buying until the market settles down.

How will you know?

Nobody knows when the market will peak or what bitcoin’s price will be when it does, but we will know when we’re getting close. The data will get clearer and clearer as we get closer, just as it did in each of the four previous market cycles.

We’re not near the market cycle peak yet but we’re getting closer with each passing day. Strong hands are giving up their bitcoin. Grayscale’s barely growing. Warning signs are flashing everywhere. If institutions are moving massive amounts of money into the market, it’s not showing up in any of the metrics or the movement of bitcoins.

If you subscribe to Crypto is Easy, I will update you way before we have to act, whether that means buying into a massive crash or selling out of a parabolic boom. Until we get one of those extremes, my plan is not actionable.

If you expect to spend the rest of the year (or forever) in a super-cycle that sends bitcoin to $1 million or more and never reach a market cycle peak, you don’t want my data to hold true. You want it to be different this time.

Maybe it will be—but what if it’s not?