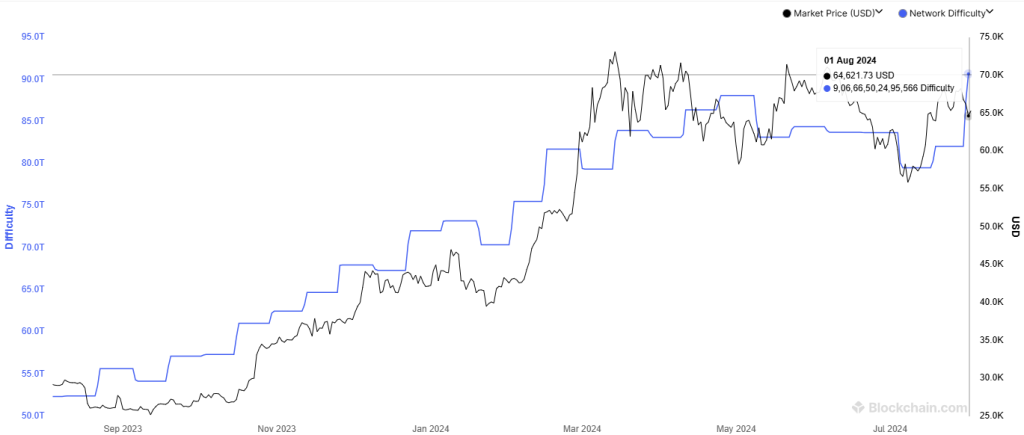

On August 1, 2024, Bitcoin’s network difficulty surged by over 10.5%, ending a three-month downward trend and setting a new all-time high. This increase in difficulty, which measures the effort required to mine a new block on the Bitcoin blockchain, adds to the operational costs of Bitcoin mining.

Between May 9 and July 30, Bitcoin’s network difficulty saw a notable decline, reducing the computational power needed to confirm Bitcoin transactions, priced at $64,699. Although a higher difficulty requires more computational power, it also strengthens the network’s security against external threats.

Network difficulty of the Bitcoin network. Source: Blockchain.com

Network difficulty of the Bitcoin network. Source: Blockchain.com

Due to a lower hashrate and infrastructure improvements, several Bitcoin mining companies, including Bitfarms, reported higher monthly earnings in July compared to previous months. However, the network difficulty spiked on July 31, reaching a new peak of 90.66 trillion on August 1, with a 14% increase likely to negatively impact miners’ earnings in the short term.

Despite this, the Bitcoin network’s hashrate has remained steady at 630 exahashes per second for nearly six months, reflecting the total computational power used for mining and the network’s relative difficulty.

Facing increased financial pressure, Bitcoin mining firms are holding onto their BTC rewards, hoping to sell them at higher prices in the future. Marathon, for example, currently holds 18,536 Bitcoin worth over $1 billion, a 48% increase from its 2023 holdings of 12,538.