Core Scientific, a struggling Bitcoin miner, has recently filed its Chapter 11 bankruptcy plan with the United States Bankruptcy Court for the Southern District of Texas Houston Division. The company, which is seeking to restructure and emerge from bankruptcy, has engaged in negotiations with key stakeholders to garner support for its proposed revival.

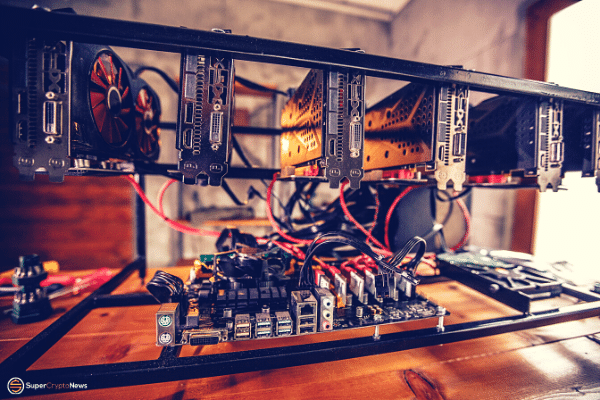

The filing indicates that Core Scientific has experienced improved liquidity since initiating the Chapter 11 bankruptcy process. The company attributes this positive development to several factors, including the surge in Bitcoin prices, an increase in the network hash rate, and reduced energy costs. Encouraged by these improvements, Core Scientific is now focusing on revamping its business strategy to ensure a successful comeback.

Under Chapter 11 bankruptcy, a company can continue its operations while working towards a restructuring plan that may involve reducing debt by downsizing business operations or selling assets to repay creditors. The Chapter 11 bankruptcy plan outlines the company’s intentions for reorganization and debt repayment.

The bankruptcy plan specifies that, upon the plan’s effective date, holders of allowed debtor-in-possession (DIP) claims will receive full and final satisfaction of their claims. These claim holders will either be paid in cash or receive alternative treatment as agreed upon.

Additionally, any liens granted to secure the DIP claims will be terminated, removing the secured interest in Core Scientific’s assets. To facilitate this process, Core Scientific obtained court approval to secure a loan of up to $70 million from investment bank B. Riley, one of its major creditors. The loan will be used to pay off the company’s existing debtor-in-possession financing loan, also provided by B. Riley.

Core Scientific initially filed for bankruptcy on December 21, 2022, following a period of declining revenue due to low BTC prices. The bankruptcy filing came shortly after a creditor extended an offer to help Core Scientific avoid potential bankruptcy.