Balaji Srinivasan, renowned venture investor and former Chief Technology Officer (CTO) of Coinbase, has forecasted a surge in Bitcoin Maximalism, asserting its ascendancy as both a philosophical stance and an economic belief system.

Srinivasan took to Twitter on Wednesday to elucidate his stance, contending that trust in the traditional financial infrastructure is poised to diminish gradually over time. He attributed this trend to the persistent inflation of the U.S. dollar, a phenomenon he believes will drive a new wave of adherents toward Bitcoin.

Recent data from the U.S. Bureau of Labor Statistics revealed a twelve-month consumer inflation rate of 3.5% in March, marking a prolonged period of deviation from the nation’s 2% inflation target. Despite efforts by the Federal Reserve to counteract inflation through significant increases in policy interest rates, Srinivasan argues that such measures entail adverse repercussions for consumers, including heightened interest payments on loans and vehicles.

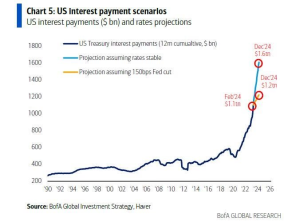

Highlighting the escalating financial burden on individuals, Srinivasan pointed to Federal Reserve data indicating a surge in personal interest payments from $240 billion in 2021 to $520 billion presently. Moreover, research conducted by Bank of America suggests that U.S. Treasury interest payments have surged to $1.1 trillion annually, with projections indicating a further increase to $1.6 trillion by the fourth quarter of 2024, should rates remain stable. Even in the event of a 150 basis point rate cut by the Fed, these payments are anticipated to escalate to $1.2 trillion.

The nation’s mounting debt, exemplified by a resurgence in debt issuance to $7 trillion in the fourth quarter of 2023, alongside an aggregate debt surpassing $34.6 trillion, according to the US debt clock, further exacerbates the financial predicament. Srinivasan warned that such precarious economic conditions could compel the government to resort to “gigantic quantities of money,” a prospect he deemed perilous, particularly in light of a growing concern among young adults, with 64% of 18 to 29-year-olds citing inflation as a primary national issue.

Characterizing the impending scenario as potentially revolutionary, Srinivasan emphasized the looming conflict between the populace and governmental institutions, the network versus the state, and crucially, Bitcoin versus the dollar. While disclaiming an allegiance to maximalism himself, he asserted that the ascendancy of Bitcoin Maximalism is inevitable.

Bitcoin maximalism, an ideology that asserts Bitcoin’s superiority over all other financial assets, including precious metals, fiat currencies, bonds, stocks, and even other cryptocurrencies, has garnered traction in recent years. Michael Saylor, the executive chairman of MicroStrategy, one of the largest corporate holders of Bitcoin globally, has publicly aligned himself with this philosophy.