Author: Inbar Preiss

On the 28th of December 2018, Time Magazine published an article titled “Why Bitcoin Matters for Freedom”. The article illustrates the paramount contribution of bitcoin in mitigating the desperate financial crisis in Venezuela.

Amidst hyperinflation, mass emigration, widespread hunger, and the biggest crisis that the country has ever seen, people in Venezuela have turned to bitcoin for financial freedom.

The article is written by Alex Gladstein, chief strategy officer at the Human Rights Foundation. The positive appearance of bitcoin in a renowned magazine and for a positive cause is great for bitcoin enthusiasts to see. While Gladstein makes a strong case for Venezuela, this is to illustrate that bitcoin offers freedom to all societies, not just those who have erupted into an authoritarian crisis.

What does freedom mean?

Here, I refer to “the West” as the culture and society which historically developed out of ancient Europe, today characterized by capitalist democracies. Politically, the West tends to equate freedom with democracy. Western thinking glorifies the ideals of democracy, dismissing any other form of governance. It is easy to overlook problems within the Self when pointing fingers at the Other.

Looking at democracy not as an abstract ideal but as an actual manifestation, is it freedom when minorities are inherently bound to suffer? Is it freedom when democracy only provides you with a handful of mediocre choices? Is it freedom when developing intelligent technologies are used to monitor your every move?

What freedom does bitcoin offer? Bitcoin allows for independence as an individual — you are an autonomous agent unrestricted by governments, banks or political systems. As Gladstein highlights: “government censorship isn’t possible, as bitcoin isn’t routed through a bank or third party and instead arrives into your phone wallet in a peer-to-peer way.”

Bitcoin is based on mutual consent, and the kind of freedom it offers is important and applicable all over the world.

Bitcoin further allows for trust in a trustless global environment, transparency, immutability, decentralization of power, and an unbreakable peer-to-peer network. All together, the first electronic cash system is historically radical and unprecedented.

The Western weaknesses

The Time article highlights the vast troubles the people of Venezuela face, and it seems natural to contrast the rigged system in place in that country with democratic capitalism. (Reminder: our ideas of international human rights are based on Western standards).

Without dismissing the difficulties of Venezuelans, it can be argued that the Western system has dangerous problems of its own. It’s not that the problems described here are only existent in the West, but they are a result of Western capitalist systems implemented worldwide.

Bitcoin guru Andreas Antonopoulos refers to the financial system as “the banking cartel”. This is made up of people and companies that get away with huge crimes since they own the media, the politicians and the regulators. It’s worth noting that only one banker was jailed in response to the 2008 financial crash, where 10 million Americans lost their homes and 5.5 million lost their jobs.

The financial system is based on debt and fraud. Fractional reserve banking fundamentally allows banks to lend money that does not exist. Yet, “bankers are granted absolute legal protection to perpetrate their fraud/crime, at the direct expense of the law-abiding citizens of that society,” notes ZeroHedge. Meanwhile, global debt has reached $250 trillion this year and growing.

The funny thing is, no one cares. The system still allow the average person to get on with their daily lives, even if someone out there is making a fortune in crooked ways. But only until the system breaks, and everyone pays the price.

Bitcoin Matters for Freedom… but over there, not here

Gladstein writes that “for people living under authoritarian governments, bitcoin can be a valuable financial tool as a censorship-resistant medium of exchange,” which is certainly significant. But pointing fingers at the corrupted nations on the other side of the world while ignoring the great potential bitcoin has for solving our own problems is short-sighted.

Venezuela is amidst its worst-ever humanitarian, political and economic crisis. Bitcoin offers victims a solution to some of the problems, evading 56% fees on wire transfers and the banks which blocked international access to accounts. Gladstein’s article further mentions the importance of cryptocurrency in Zimbabwe, Russia and China since it can escape the claws of the leaders.

Perhaps equally important as allowing people to fight against injustice in all these countries, cryptocurrency is just as powerful a tool to fight injustice in the West. For example, bitcoin can offer shelter from the storm of the next financial crash. While the 2008 crisis was caused by the housing market bubble, today the student loan crisis is foreshadowing the next collapse.

But hopefully, when another crisis will inevitably erupt, an alternative digital economy will be available. Richard Olsen, founder of Lykke, the global marketplace platform, says:

“When the day of reckoning comes, in the form of the next financial crisis, the new world will be ready. We will be able to flee the traditional system and move into a digital safe haven.”

Yes, bitcoin can certainly help people in countries like Venezuela attain a degree of freedom. But let us not discard the importance it can play in places like America and Europe, where corruption is veiled under a lot of bureaucratic fluff. The “liberating potential” Gladstein refers to is applicable to every society suffering from corruption.

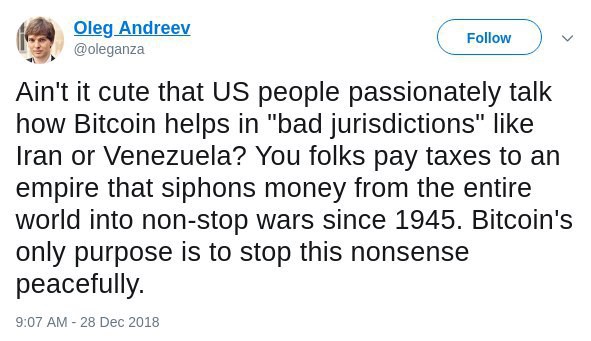

This sentiment is accurately described in a recent tweet by software designer and crypto-anarchy historian Oleg Andreev:

Crypto’s harshest critic

Bitcoin is easily bashed by those who live a good life. In an interview on What Bitcoin Did podcast, Gladstein says:

“A lot of the dismissals, criticisms and attacks on Bitcoin come from people who have the luxury of having a stable financial system.”

This remark is in good taste. It is true that bitcoin and other cryptocurrencies are more harshly received in developed nations where average citizens don’t need to worry too much about the bread on the table, and can hope their voting power will usher in a better leader at the next elections. People are quick to remark on the fishiness of anonymous money: how it can be used to buy from the contents of abyss of the dark net, fund the terrorists, and launder the local drug mafia’s cash. Legal regulation ensues.

The push towards more regulations emphasize the government’s deep desire to maintain control and power. Same for the push towards cashless societies, since electronic transactions are easier to monitor than fungible cash. Data about us is collected everywhere — biometrics are casually collected (on our phones as well as in many bureaucratic offices), and our life is monitored and recorded.

Should an authoritarian regime arise in a Western nation — and if we take a moment to reflect we can reach the frightening conclusion that we are not so far from it — all the tools for totalitarian control are in place, and there is plenty to fear. The point is — we will need bitcoin just as much as the people of Venezuela. Many problems that Gladstein mentions is just as relevant here as it is there.

Perhaps we just need another financial crash to realize it?

Bitcoin is a solution for all

Writer and economist Nassim Nicholas Taleb, who is quoted in Gladstein’s article, writes:

“[Bitcoin’s] mere existence is an insurance policy that will remind governments that the last object establishment could control, namely, the currency, is no longer their monopoly. This gives us, the crowd, an insurance policy against an Orwellian future.”

An Orwellian future is marching into the present, even your grandma can tell you that. This aspect of bitcoin Taleb describes is equally important in all flawed societies. The crookedness of the Western systems may be wrapped a bit more delicately, but the same corruption by power lies underneath. Venezuela crisis teaches us that we all must do what we can to protect our freedom.

Bitcoin can be a tool of protest and nonviolent resistance, a tool of peaceful exchange and of tolerance. The role of bitcoin may be different in different societies, but its potential is the same.

Gladstein concludes his article with:

“More than 50% of the world’s population lives under an authoritarian regime. If we invest the time and resources to develop user-friendly wallets, more exchanges, and better educational materials for Bitcoin, it has the potential to make a real difference for the 4 billion people who can’t trust their rulers or who can’t access the banking system. For them, Bitcoin can be a way out.”

The other 50% of the world lives under a capitalist democracy, where often everyone but the powerful elites are exploited. We need to invest in better bitcoin infrastructure for another 3.7 billion people who can’t trust their rulers and are ruled by the banking system. For everyone, bitcoin is a way out.

Does bitcoin matter for freedom? Yes, it matters everywhere.