Cryptocurrency exchange Binance unveiled the plan to gradually discontinue its support for the BUSD stablecoin, leading to its removal from both spot and margin trading pairs. In a recent announcement on Thursday, users have been advised to transition their BUSD holdings into alternative assets by the deadline of February next year, media reports said.

Taking more immediate steps, Binance will first delist BUSD as a loanable asset on September 6. Subsequently, withdrawals of Binance-pegged BUSD tokens via BNB Chain, Avalanche, Polygon, and Tron will be halted on September 7.

The anticipation of this decision to terminate BUSD support arose following the directive issued in February to halt the minting of the stablecoin by its issuer, Paxos. Back then, Binance’s CEO, Changpeng Zhao, had mentioned that the gradual winding down of BUSD would occur over time, but the exact timeline remained unclear. The decision to abruptly halt BUSD loans with only a few weeks’ notice suggests an accelerated schedule.

“BUSD products will be progressively phased out as Paxos has ceased minting new BUSD. It is important to note that BUSD will always maintain a 1:1 backing with the USD,” stated Binance. According to data from CoinMarketCap, the 24-hour trading volume of BUSD hovers just below $900 million.

The stability of BUSD had been compromised due to regulatory conflicts, initiated by the New York Department of Financial Services (NYDFS) instructing Paxos to discontinue its issuance in February. Subsequently, the U.S. Commodity and Futures Trading Commission (CFTC) filed a lawsuit against Binance, alleging the offering of unregistered crypto derivatives products in violation of federal law.

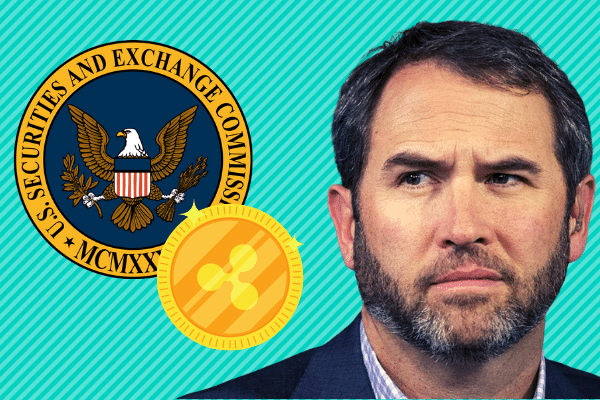

In a recent development, the spotlight is back on Binance as the U.S. Securities and Exchange Commission (SEC) submitted a sealed motion concerning the exchange, allowing confidential information to be filed without public disclosure.