We may remember 2023 as the year the US lost crypto.

At this point I just want a full divorce of crypto from the U.S. government.

The rules are thus: we get no banking, opt out of all regulatory protections, no dollar reserved stablecoins. In return, we liquidate all ETP products, pay no taxes on crypto to crypto transactions, and…

— Ryan Selkis (d/acc)🪳 (@twobitidiot) November 30, 2023

Some think they can make up for it by approving a spot Bitcoin ETF.

That ETF doesn’t do anything for crypto. It’s simply a way for Wall Street to make money off of people who want to gamble on bitcoin without taking possession of it (they buy and sell the fund, not bitcoin).

Money for everybody else

Money’s already moving overseas.

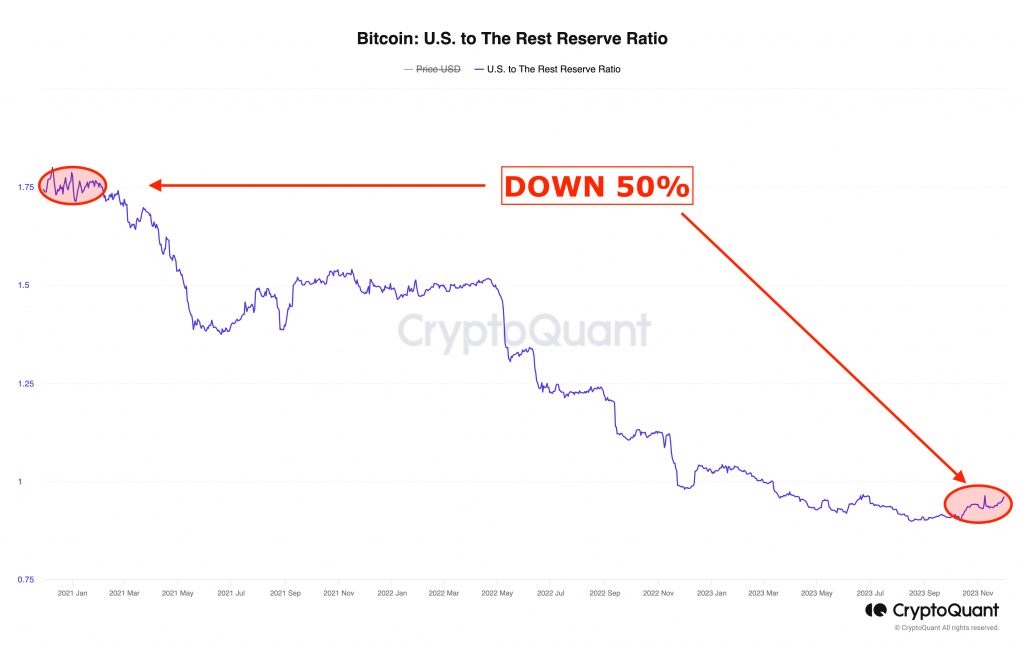

You can see this in many ways. I find the best single chart example comes from CryptoQuant’s U.S. to The Rest Reserve Ratio, which shows a big drop in the proportion of crypto in the hands of known US entities and users compared to crypto in entities located in the rest of the world over the past three years.

Everywhere else.

There are 7 billion people who don’t need to care about the US or its regulators. Many of them live in countries with growing economies, favorable demographics, and no wars to fund. They won’t necessarily suffer if the US goes into a recession.

On top of that, many of their countries are building regulatory frameworks for crypto. Even China’s government let Hong Kong get into the crypto business (and recently started throwing hundreds of billions of dollars into its economy).

Look at Google Trends across any random timeframe for crypto search terms on a “worldwide” setting.

What do you notice?

The US ranks low on the list of countries that show interest in these search terms. It was number 24 on the day I checked. Many non-English-speaking countries ranked higher.

(Google doesn’t survey China and some other large countries but you can bet the US would rank lower if it did.)

Maybe the US doesn’t matter that much anymore

Do we need the US?

US entities and institutions dominated the market in 2021 and 2022. That didn’t work out so well.

Especially when you add some hostile actions among a small group of regulators, for example, a haphazard, modestly-effective attempt to cut off crypto businesses from the US banking system.

I’m talking about Nic Carter’s “sophisticated, widespread crackdown” on crypto banking. “Chokepoint 2.0.”

How did that go?

All of the targeted businesses are still in business. At least one of these so-called “crackdowns” almost caused a global financial crisis. Only the banks failed.

The US government loses case after case. Some of its activities have opened up sensitive jurisdictional battles among Federal agencies. Congress plans to investigate perceived incompetence and bad-faith actions.

If that’s what you get with a “sophisticated, widespread crackdown,” I’d hate to see what an incompetent, uncoordinated crackdown looks like.

As best I can tell, the US government has made everything harder, riskier, and more expensive for US entities and put some good people out of work.

We still have frauds, money launderers, criminal elements, shady exchanges, and everything else that comes with crypto.

Money, talent, and innovation? Those fled elsewhere.

Crypto’s Financial Gas Station

Congress has done nothing about crypto. Regulators keep trying to attack the industry. The courts keep shutting them down. The White House has shown no leadership on the matter.

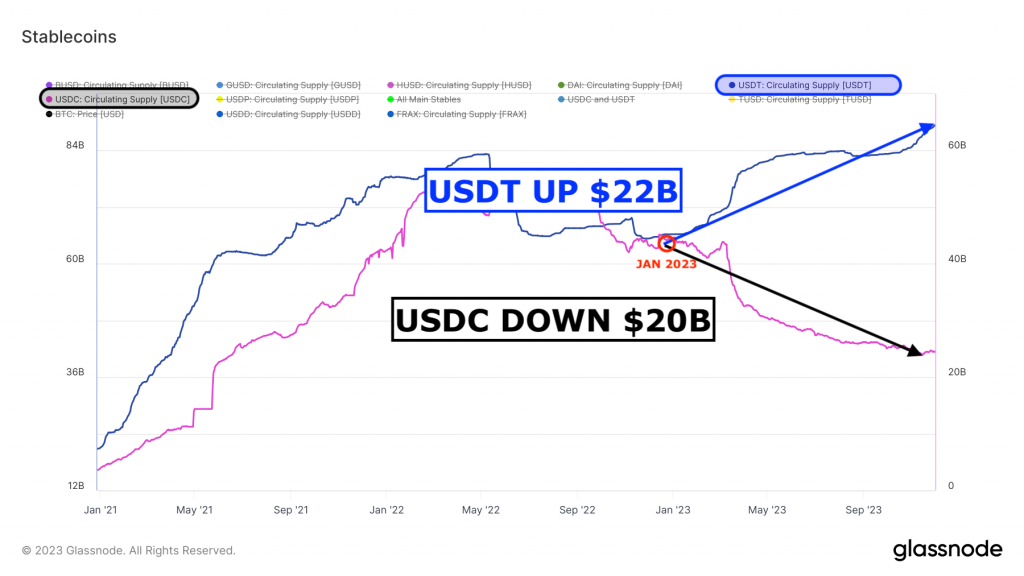

Since January 2023, the compliant US-based stablecoin, Circle, has lost $20 billion market share while the non-compliant, foreign stablecoin, Tether, has gained $22 billion market share.

Certainly, Wall Street will fill the gap with “safe, regulated crypto,” starting with ETFs and registered securities offerings.

That’s great for Wall Street. It doesn’t necessarily do anything for the US.

Some of the best builders already left. Some of the best new protocols come from other countries. Some of the best existing protocols have participants all over the world. Every cryptocurrency project benefits from new money, no matter where the money comes from.

Follow the money

When you buy cryptocurrency, money exits the US financial system.

With so much of the industry moving overseas, that money is only coming back when it’s time to “take profits”—and the US has a smaller share of those profits than it has in years.

Ironic, innit?

Those crypto projects went overseas, but they’ll get money through Wall Street funds anyway.

US money with none of the hassles that come from US regulators.

Maybe that’s the best outcome for everybody.

The US can continue to bury its head in the sand.

We can continue to build and support the financial networks of the future.

Everybody wins.

But we win more.

This post is also available as a collectible NFT at https://mirror.xyz.

https://mirror.xyz/0x9a6600c7B40801dda9A0Fa4E8DE7b1B99FE524a7/-XgtTAGaYmS7ZOu61OXh5LxHSnITHeMLKuNrFl659BI

Mark Helfman publishes the Crypto is Easy newsletter. He is also the author of three books and a top Bitcoin writer on Medium and Hacker Noon. Learn more about him in his bio and connect with him on Superpeer or Tealfeed.