-

The U.S. Securities and Exchange Commission seems intent on doling out diet bitcoin for investors, with two equity ETFs trading in the U.S. and a third being approved by the agency, even as investors are calling for a full flavor bitcoin ETF.

- Speculation is rife on whether the SEC may approve a full-flavored bitcoin ETF, with encouraging comments by SEC Chairman Gary Gensler in August, fueling hopes that it will happen eventually.

The main issue with “diet” soda is that it’s not entirely satisfactory – you don’t quite get the full flavor of the beverage, and you don’t feel satiated, making you eat more of other stuff.

Yet the U.S. Securities and Exchange Commission seems intent on doling out diet bitcoin for investors, with two equity ETFs trading in the U.S. and a third being approved by the agency, even as investors are calling for a full flavor bitcoin ETF.

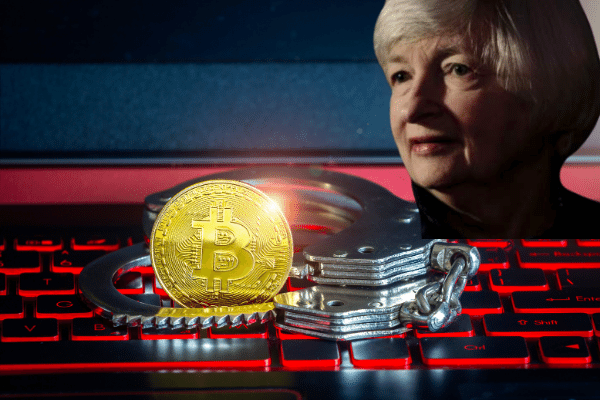

The SEC has so far declined to approve any ETFs that invest in bitcoin itself, even though a slew of asset managers have applied to do so and similar vehicles are already commonplace in Sweden, Switzerland, Germany and Canada.

Speculation is rife on whether the SEC may approve a full-flavored bitcoin ETF, with encouraging comments by SEC Chairman Gary Gensler in August, fueling hopes that it will happen eventually.

Demand for a dedicated bitcoin ETF is high, with Grayscale Bitcoin Trust having grown to US$35 billion since its launch in 2013, and net flows into dedicated cryptocurrency funds hitting a four-year high of over US$2.5 billion last week, according to data from EPFR.

And while a Canadian bitcoin ETF has been around for a while now, a U.S. bitcoin ETF remains elusive.

Instead, the SEC has approved ETFs which invest in companies that are “materially” engaged in cryptocurrency-related activities, including mining, trading and infrastructure, as well as over-the-counter private investment trusts linked to cryptocurrency.

From the perspective of the SEC, these crypto-equity ETFs are far less risky than a fund that invests directly in bitcoin.

Last week, testifying before the House Financial Services Committee, Gensler described cryptocurrency finance as the “Wild West” adding,

“This asset class is rife with fraud, scams and abuse in certain applications. We can do better.”

If so, wouldn’t a regulated bitcoin ETF be a good place for the SEC to start?