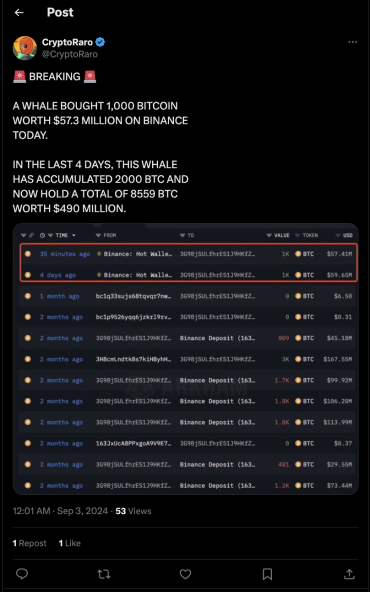

In a remarkable display of confidence in the cryptocurrency market, a single whale address has accumulated a staggering 2,000 Bitcoin (BTC) worth approximately $117 million in just four days. This whale, who previously sold $467 million worth of Bitcoin in July, has now withdrawn a total of 2,000 BTC from the Binance exchange at an average price of $58,525.

The whale’s wallet now holds an impressive 8,559 Bitcoins, valued at around $490 million. This move comes at a time when other top anonymous wallets and whales have remained relatively inactive.

Whales Buying While Retail Sells

The whale’s accumulation of Bitcoin stands in stark contrast to the behaviour or of smaller traders. Data from analytics platform Santiment shows that in August, wallets with 10-10,000 BTC have collectively added 133,300 more coins while smaller traders continue to sell their holdings. This trend is further evidenced by the increase in Bitcoin whale wallets holding at least 100 BTC. In just one month, the number of such wallets has reached a 17-month high of 16,120, despite disappointing prices for retail traders.

Institutional Confidence Remains Strong

The whale’s actions are not an isolated incident. Cypherpunk and CEO/Co-founder of Blockstream, Adam Back, reports that whales have been buying Bitcoin at impressive rates since the recent dip below $58,000, with an estimated 450 BTC being purchased every minute. This trend is also reflected in the ETF industry, where a significant portion of new launches this year involve crypto. Remarkably, 13 out of the top 25 ETF launches in 2024 are related to Bitcoin or Ethereum, with the top four being spot Bitcoin ETFs, attracting a total of $35.1 billion in year-to-date flows.

Potential Impact on Bitcoin Price

The increased net outflows of Bitcoin from exchanges, with over 16,500 BTC worth more than $1.01 billion leaving in the past seven days, suggest potential accumulation by investors. This movement shows that the accumulation phase might have started, despite bearish expectations for September.While September has usually been bearish for the BTC price, data shows that October’s monthly gains over the past 11 years have been impressive. Bitcoin had a bearish start to this month but regained 2.1% over the past 24 hours, trading at $58,900 with a market cap of $1.16 trillion.

In conclusion, the actions of this whale, along with the broader trend of institutional investment and whale accumulation, suggest a potential shift in the cryptocurrency market. As retail traders continue to sell, whales and institutions are seizing the opportunity to accumulate Bitcoin at discounted prices, potentially setting the stage for a future price surge.