Defiance’s new and controversial single-stock long leveraged MicroStrategy exchange-traded fund (ETF), trading under the ticker “MSTX,” has seen $127 million in inflows over the past six days, according to Bloomberg Intelligence data.

Defiance MicroStrategy ETF Sees $127 Million Inflows

The Defiance MicroStrategy ETF has captured significant investor attention, attracting a remarkable $127 million in inflows. This surge highlights growing confidence in the cryptocurrency market, especially regarding Bitcoin, which is at the core of the ETF’s strategy.

What is the Defiance MicroStrategy ETF?

The Defiance MicroStrategy ETF allows investors to gain exposure to MicroStrategy, a company renowned for its bold Bitcoin acquisition strategy. By investing in this ETF, individuals can tap into MicroStrategy’s substantial Bitcoin holdings without directly buying the cryptocurrency. Is this the best way for investors to engage with Bitcoin? As institutional interest in Bitcoin rises, this investment vehicle has gained popularity among savvy investors.

Recent Inflows and Market Trends

The recent $127 million inflow into the Defiance MicroStrategy ETF stands out, especially in the context of broader cryptocurrency investment trends. The ETF’s performance closely tracks Bitcoin’s price movements, which have shown resilience and growth. Speculation around potential Federal Reserve rate cuts has fueled a bullish sentiment in the cryptocurrency sector. In fact, Bitcoin ETFs collectively saw $252 million in inflows recently, signaling a strong uptick in investor confidence.

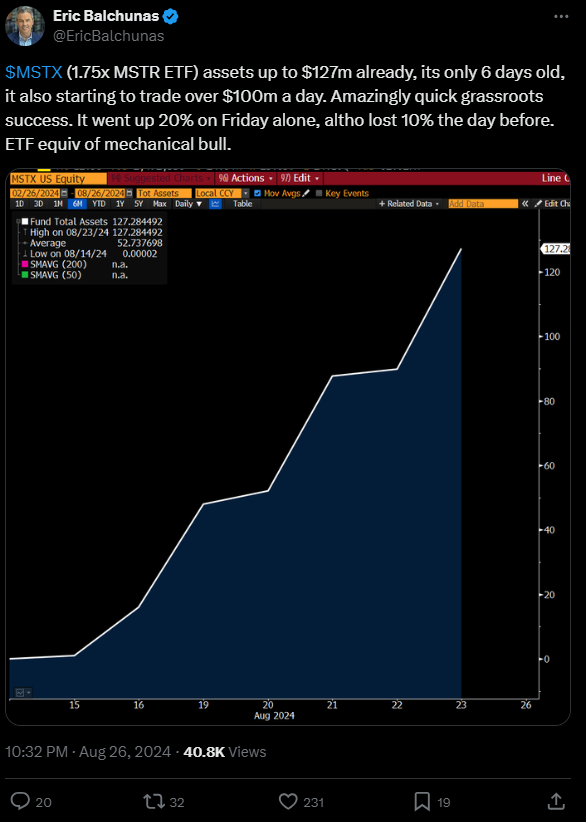

The MSTX ETF began trading on August 21 and has averaged over $100 million in daily volume, as noted by Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence.

Balchunas further mentioned that these significant inflows indicate the ETF is experiencing rapid grassroots success.

Eric Balchunas post on social media platform X.

What This Means for Investors

These inflows into the Defiance MicroStrategy ETF indicate a shift in market dynamics. More investors are looking to leverage institutional strategies for exposure to cryptocurrency. This trend suggests that many now view Bitcoin as a viable asset class, particularly in light of macroeconomic factors that could influence its price.

The $127 million inflow into the Defiance MicroStrategy ETF underscores a growing trend among investors to engage with Bitcoin through institutional channels. As the cryptocurrency market continues to evolve, ETFs like this one will likely play a crucial role in shaping investment strategies and driving further adoption of digital assets.

Disclaimer

Any information provided in this article is not intended to be a substitute for professional advice from a financial advisor, accountant, or attorney. You should always seek the advice of a professional before making any financial decisions. You should evaluate your investment objectives, risk tolerance, and financial situation before making any investment decisions. Please be aware that investing involves risk, and you should always do your own research before making any investment decisions.