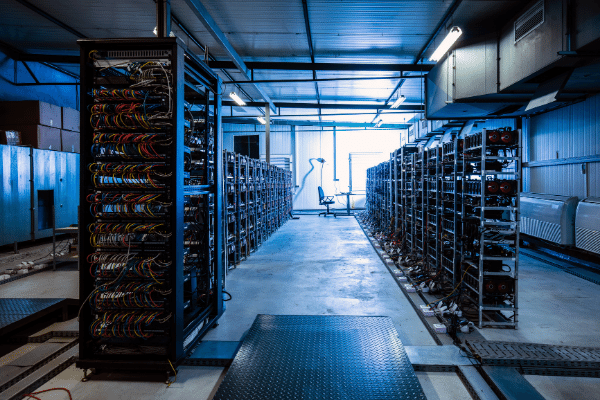

Bitfarms, a bitcoin mining company based in Toronto, has reported a loss in the fourth quarter of 2022 due to a decline in bitcoin’s price, increased mining difficulty, and rising costs. As per reports, the company missed its target for computing power of 5 exahash per second (EH/s) and only attained 4.5, which was lower than its initial objective of 7.2 of the whole EH/s.

Despite the challenges, Bitfarms is optimistic about its future prospects and is examining acquisition opportunities to enhance its geographically diverse mining operations. By the end of 2023, Bitfarms intends to enhance its computing power to 6.0 EH/s by using equipment credits and its current infrastructure in Argentina.

Bitfarms and additional miners such as Stronghold Digital Mining have been attempting to reduce its debt liabilities amid the cryptocurrency market’s downtrend. In February, Bitfarms settled $21M of unsettled debt with bankrupt lender BlockFi, resulting in an 86% reduction in debt obligations compared to June 2022.

The mining difficulty for Bitcoin increased during the fourth quarter of 2022 as more computing power joined the network, making mining less profitable. Bitfarms’ gross mining margin fell to 33% from 52% in the previous quarter, and the mining profitability, measured in Luxor Technologies’ hashprice, declined by 25% in the three months.

Bitfarms’ CEO Geoff Morphy believes that the company’s strengthened balance sheet and existing assets will enable it to expand its computing power to meet its 2023 goal. The company’s diverse mining operations and potential acquisitions are expected to boost its revenue and earnings before tax, interest, depreciation, and amortization (EBITDA) in the forthcoming years.