Major cryptocurrency exchange Binance’s USD-pegged stablecoin (BUSD) has continued to sink in the midst of BUSD mishandling that occurred earlier this month, along with other mishaps.

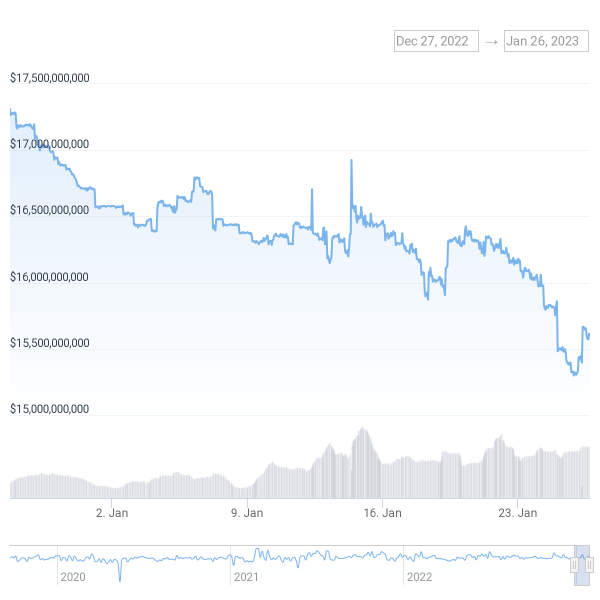

The data from CoinGecko shows that the circulating supply of BUSD decreased to $15.4 billion on Wednesday, a decrease of $1 billion over the previous week and $2 billion over the previous month. The most recent dip increased BUSD’s loss from $22 billion at the beginning of December, when users rushed to withdraw money from Binance in a panic after it misrepresented the amount of digital asset holdings in its reserves.

Recent reports about errors with the exchange’s wrapped token derivatives, known as Binance-peg tokens, have coincided with the most recent fall.

Blockchain research company ChainArgos is cited by Bloomberg to have discovered earlier this month that the Binance-tethered BUSD was not always completely backed by reserves in 2020 and 2021. Binance claimed it has rectified them after acknowledging the vulnerability. This week, Bloomberg reported that the exchange had combined customer funds with Binance-peg token collateral.

Retail traders may suffer a setback when Binance’s banking partner Signature Bank stops using the SWIFT interbank messaging system for transfers under $100,000 as of February 1.