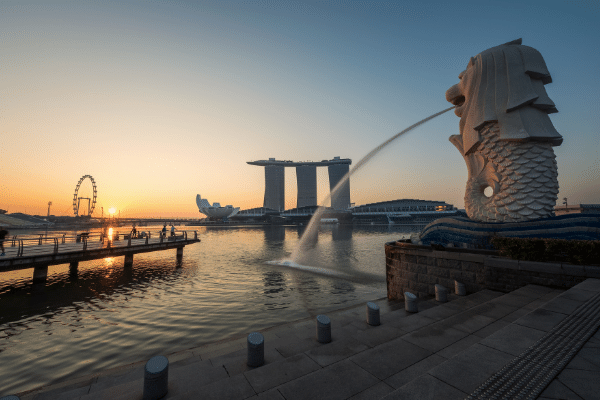

In order to prepare for new cryptocurrency rules that address the ongoing liquidity crisis and withdrawal concerns, the Monetary Authority of Singapore (MAS) has begun to take action.

Certain applicants and licence holders for the MAS’ Digital Payment Token have reportedly received lengthy questionnaires from Singapore’s central bank.

The questionnaires, which were distributed over the past month, purportedly sought “highly granular information” regarding the operations and assets of the inspected crypto businesses.

The focus of the inspections was on the financial health and interconnection of the companies. The topics covered include the top tokens owned, top lending and borrowing counterparties, quantity lent, and top tokens staked via decentralised finance protocols.

The report states that companies were expected to respond quickly and cites persons with knowledge of the situation.

The actions are being taken in advance of anticipated changes to cryptocurrency regulation in the city-state, where officials are attempting to balance encouraging innovation on the one hand while keeping the consequences of collapsing businesses and retail investors being burned by market volatility.

Ravi Menon, the managing director of MAS, has already warned the industry that the regulations’ purview will be expanded to include more activities and will attempt to address these issues next week.

The MAS has so far granted 10 licences to cryptocurrency businesses in Singapore, including exchanges like Crypto.com and the brokerage division of DBS Bank called DBS Vickers. Out of the nearly 200 known firms that have sought for the licence, that is a very small portion.

The most recent regulatory measure in Singapore appears to be intended to increase oversight of cryptocurrency companies in light of impending new laws for the sector.

The financial watchdog is developing a regulatory framework to cover “consumer protection, market conduct, and reserve backing for stablecoins” in the upcoming few months, according to Menon’s announcement in mid-July.

The MAS particularly referred to gaps in Singapore’s current crypto legislation, saying that companies that provide services for digital payment tokens are not subject to risk-based capital or liquidity requirements.

Additionally, they are not currently required to protect client funds or digital tokens from bankruptcy risks. Instead, legislation primarily focuses on technological hazards, money laundering, and terrorism financing threats.