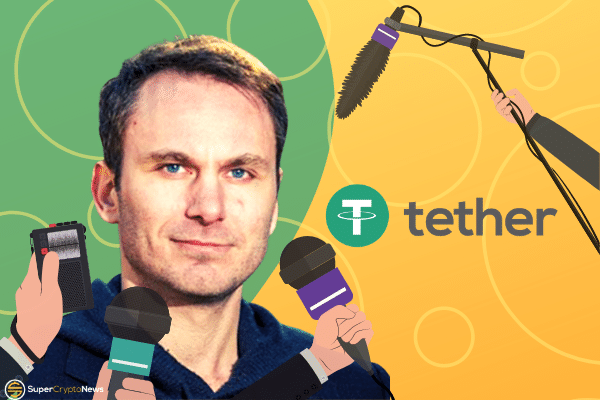

In an exclusive interview with Paolo Ardoino, CTO at Tether, Ardoino answers the following series of questions posed by the SuperCryptoNews team.

-

Will stablecoin be seen as a competitor with CBDC in the eyes of the regulator?

Regulators might view stablecoins as competitors with Central Bank Digital Currencies (CBDCs). We believe that stablecoins represent an important technological innovation and that regulations should evolve to facilitate the growth of this amazing technology.

Our industry has grown exponentially over the past few years with the market capitalization of Tether tokens (USDt) now standing at >US$34 billion. This growth has took place in the face of significant challenges. We hope regulators will recognise this. We believe that stablecoins can co-exist with CBDCs, as both can play an important role in the future of mainstream finance.

The move towards CBDCs is in many respects an endorsement of the stablecoin model. Stablecoins can help to solve several issues that banks have today. USDts are the most popular stablecoins among traders and developers, providing a blueprint for how such a CBDC may work.

-

With the recent launch of Binance Pay which allows their BUSD to be used as payments in a frictionless way, will Tether envisage creating your own app to facilitate ease-of-use for USDT payments?

While USDt is already supported by numerous payment gateways and e-commerce platforms, we are always looking for new ways to improve the ease-of-use of payments with USDt. Tether will continue to innovate and respond to the needs of our growing customer base.

-

What makes a stablecoin more “cash-like” than a CBDC?

I can only speak for the qualities of stablecoins, and more specifically that of USDt, which is built on a blockchain-enabled platform designed to facilitate the use of fiat currencies in a digital manner. Our users are the custodians of their own property and have flexibility among blockchains.

Aside from the U.S. dollar, we also have Tether tokens that are pegged to the euro (EURt) and offshore Chinese yuan (CNHt). This allows goods and services to be priced in multiple currencies that are already familiar and used by a significant portion of our growing customer base. USDt is also designed to facilitate cross-border payments and transactions.

-

Transacting in Stablecoin requires on-chain settlement which is slow and expensive. How does a stablecoin provider address this? i.e. Binance Pay offers stablecoin via internal ledger settlement which offers zero fee and near instant confirmation.

It is not correct that stablecoin settlements are slow and expensive. On the contrary, transacting in a stablecoin like USDt is actually swift and low cost, as USDt is built on top of open blockchain technologies that facilitate fast transactions within a secure network, reducing operating costs by bypassing financial institutions.

For example, USDt already provides faster payment as compared to credit cards and traditional payment systems. Further, we integrated USDt onto the OMG Network last year, which helps to further reduce confirmation times, make payments faster, and lower transaction costs. Tether also offers a number of blockchain options, so that users can pick the characteristics that are right for them.

-

To facilitate broader adoption, what onramp and offramp measures are planned for merchants and consumers?

The Tether platform is already an onramp and offramp for eligible verified users who are either businesses (such as payment processors and merchants) or individuals.

As part of the verification process, customers must undertake our complete KYC process and establish their identity, business type, source of funds, and related items. We have a robust anti-money laundering (AML), countering the financing of terrorism (CFT), and sanctions compliance programme.

We perform enhanced due diligence on every customer. All onboarding and transactions are subject to Tether’s terms of service, minimum thresholds, and fee schedule. Users can also deposit and withdraw USDt on supported exchanges, such as the Bitfinex platform, where they can deposit and withdraw USDt using the OMG transport layer or as ERC20 tokens.

The SuperCryptoNews team would like to thank Mr Ardoino for sharing his thoughts.