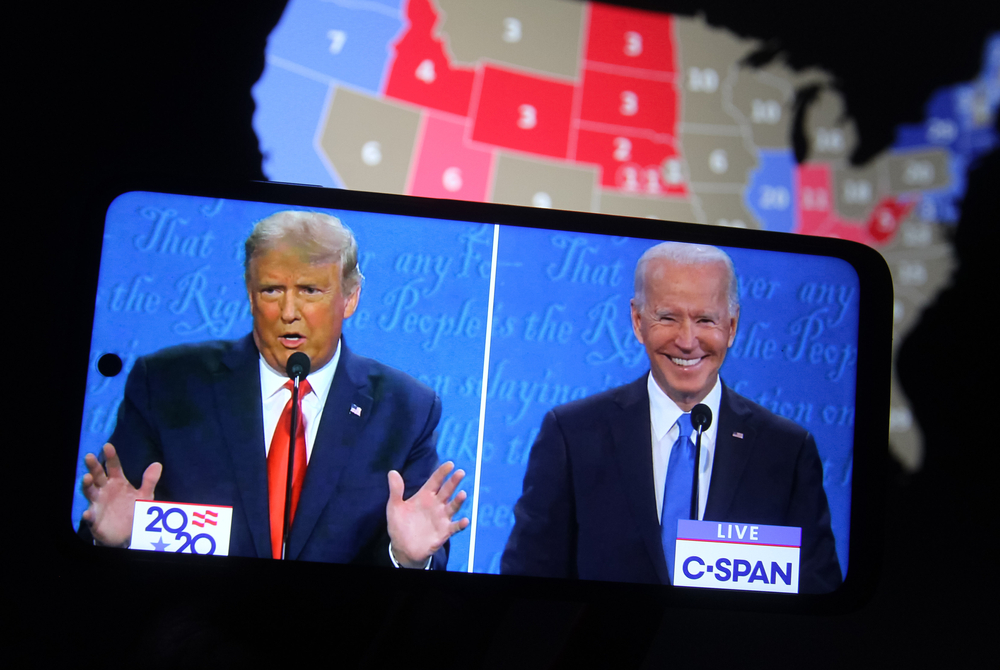

The global investment markets experienced high volatility in the past 24 hours as all eyes are on the US 2020 election, which is coming to a grand finale.

The vote counts continue for the second day and the winner of the election is slowly becoming more apparent. The Democrat party’s candidate, Joe Biden, now only needs to win Nevada to have a total of 270 electoral votes, deeming him the winner.

Markets in green

It’s green everywhere you look today as uncertainty fades when Biden takes the lead and needs only 6 EVs to be named the 46th president of the United States. Bitcoin (BTC) soared to the new multi-year high at $14,390 while equity indices also spiked in the same direction. Nasdaq rose 4.41% last night as S&P 500 and Dow Jones also closed the trading day in green.

On the other side of the world, Asia’s stock markets also opened the trading day on a positive note. Thailand’s SET index bounced from the swing low and is now being traded above 1,200 points again. The Shanghai Composite adjusted slightly upward at 3,306 points and Japan’s Nikkei is gearing up to break an all-time high at over 24,000 points.

The Altcoins market is also experiencing mild recovery today but it is still suffering from a bleed out as money flows into a more prominent cryptocurrency like Bitcoin. The market dominance of BTC has reached a six-month high at 65% according to data from Tradingview.

The high and mid-cap coins and tokens are trailing behind as BTC pushes for higher prices. Ethereum (ETH) reclaimed the $400 level once again while Litecoin (LTC) and Bitcoin Cash (BCH) performed considerably well with more than 2% gains in the past 24 hours.

However, DeFi projects’ tokens seem to be missing the train as most of them are still failing to find support, thus falling to new lows. On the bright side, the Total Value Locked (TVL) on DeFi protocols manages to hold above $11 billion signalings that investors are not entirely giving up on the decentralized alternative just yet.

Read more: DeFi Continues to Decline – Is it Truly Over?

What could happen after the election is won?

It can be expected that the markets will react positively to the clear winner if Biden manages to win the state of Nevada today. Despite the fact that the Democrats’ socialist MMT policies and tax plan could have a long term effect on the markets, investors hate uncertainties more than anything.

However, even if Biden wins Nevada and reaches the 270 EVs target, the battle might not be over. Trump has made it clear that he will not accept defeat and will urge for a recount and ultimately bring this into the Supreme court.

“As far as I’m concerned, we already have won,” Trump said.

“We’ll be going to the U.S. Supreme Court. We want all voting to stop. We don’t want them to find any ballots at 4 a.m. in the morning and add them to the list,” the US president said in the statement yesterday.

If Trump is able to reclaim Nevada, however, we will have to wait for the ballot counts for Georgia and Pennsylvania, the hometown of Joe Biden, which may take days or even a week to complete. In this case, expect volatility to resume as the markets will fall back into the state of uncertainties until we actually have a clear winner.

For now, investors still have to keep an eye on the result. Whoever wins the election, will be the one to determine the geopolitical status quo and direction of the world’s economy in the years to come.

You may also want to read: How Crypto & Blockchain Have Featured in the 2020 US Elections